Today we are pleased to present our eighth annual list of information technology companies where young people should start their careers. Many people ask us why a next generation banking service would go to the trouble of publishing this list. Our objective is to help our clients manage their short and long term financial needs. We can think of no advice that impacts our clients’ long term financial state more than helping them make the right career choices. It’s one of the many ways we build an unprecedented level of trust with our clients.

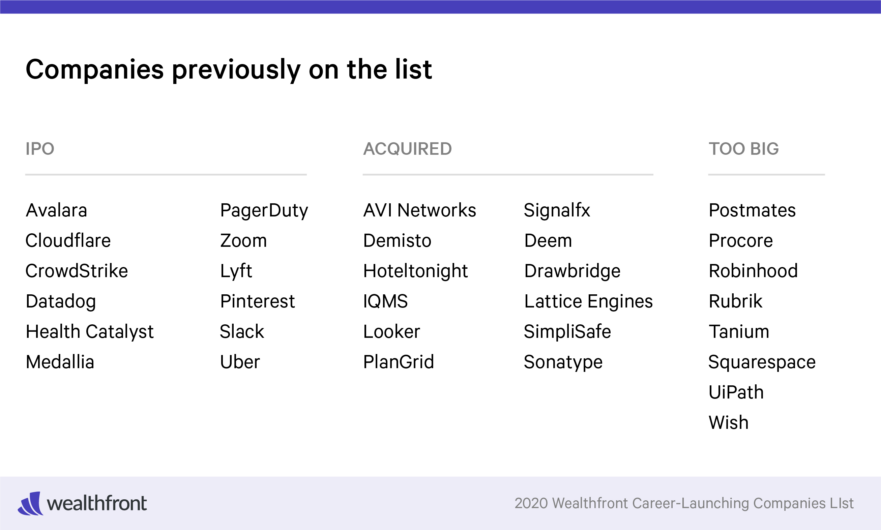

We are very proud that more than 100 companies from our annual lists have gone on to become public companies or be acquired for sizable sums over the past eight years. We know of no other annual list that comes close to helping young people get off to a great start building their careers in technology.

By being part of a very successful company early in your career, you build a halo that not only leads to faster upward growth, but greater financial rewards as well. It’s advice I have been giving my Stanford MBA students for 15 years. For a comprehensive view into all the career advice I give, I encourage you to read our Silicon Valley Career Guide.

Methodology

To qualify for our list of mid-sized companies with momentum, a company must be US-based, privately held, have a revenue run rate by year end of between $20 million and $300 million, be on a trajectory to grow at a rate in excess of 50% for at least the next three or four years, and have compelling unit economics. Selling a product at very low margins can lead to rapid revenue growth, but it doesn’t necessarily imply a great long-term business.

We built our list by surveying partners of the following 16 premier early and late stage venture capital firms: Accel Partners, Andreessen Horowitz, Benchmark, Coatue, Dragoneer, Greylock Partners, Index Ventures, Kleiner Perkins Caufield & Byers, Matrix Partners, Redpoint, Ribbit Capital, Social Capital, Spark Capital, TCV, Tiger Global and Unusual Ventures. As always, we may have missed a few companies, but we feel confident that our list is pretty all-encompassing.

This year’s biggest observation

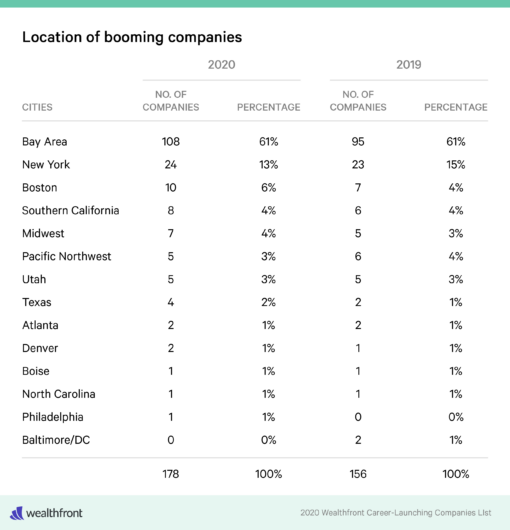

This year saw by far the largest number of new companies added to our list: 71. As a matter of fact, that’s almost 40% higher than our previous record year. This number really speaks to the amount of innovation that continues to be driven by the Internet. You might also be surprised to learn that the Bay Area actually gained share among these new additions. There is a popular narrative that other geographies are catching up to Silicon Valley in terms of important company formation. Our data proves otherwise.

Changes since last year

This year’s list includes 178 companies, up 22 from last year’s 156. We added 71 new companies, which as I said before is the highest one-year increase in our eight-year history. We dropped 49 companies, which includes 8 that went public, 12 that were acquired (many of which were acquired for more than $1 billion), a record 8 that grew beyond the $300 million revenue qualification cap, 14 that experienced growth that was too slow to continue to qualify (in line with the eight-year average) and 7 we considered no longer appropriate for the list (media or healthcare businesses).

Four companies that we dropped from the list in prior years for growing beyond $300 million of annual revenue went public this past year at astronomical valuations. Most of these stocks have not performed well as public companies, but they generated tremendous wealth and opportunity for their current and former employees.

Other fun facts

As usual, the majority of the companies are based in the Bay Area (61%), which is approximately the same level as previous years. In reality the Bay Area gained share because 70% of the companies that went public or were acquired were from there. That’s the way you want to lose share! The majority of the Bay Area companies (61%) are still located in San Francisco rather than Silicon Valley. That’s up from 55% last year, but down from a peak of 70% in 2015.

A few geographies gained slight share this year, but generally speaking the relative market shares remained approximately the same. While other regions may be experiencing an increased level of startup activity, it still appears that the more successful companies are likely to be based near Silicon Valley. This means you should seriously consider moving to the Bay Area to launch your career and then think about moving home to start your own company once you’ve gained the halo and experience.

Enterprise share declined slightly from last year’s 66% to 65% of the companies. Once again only 9 of the Bay Area consumer-focused companies are located in Silicon Valley, but that’s up slightly from only 5 in 2018. There are only three hardware companies left on the list, and surprisingly, two are based in Boston.

Perhaps my biggest takeaway from the analysis of the companies that comprise this list is how consistent all the shares are year in and year out despite the increase in company formation around the country. In the end, all that matters is being part of one of the companies that qualifies for this list.

Your career matters to your financial future

We hope you find this year’s list helpful. If you are an engineer, we provide slightly different advice, which can be found on our engineering blog. No matter what your background, we believe this list can help young professionals looking to rapidly grow their careers. And once you’ve achieved some success, we hope you will consider using Wealthfront as your next generation banking service.

By the way, if you still haven’t opened a Wealthfront account, we encourage you to do so. It’s easy to get started: the minimum for our high-yield cash account is only $1, and the minimum for our investment account is only $500.

Disclosure

This blog is powered by Wealthfront Software LLC (“Wealthfront”) and has been prepared solely for informational purposes only. Nothing in this communication should be construed as an offer, recommendation, or solicitation to buy or sell any security or a financial product. Any links provided to other server sites are offered as a matter of convenience and are not intended to imply that Wealthfront or its affiliates endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Cash Account is offered by Wealthfront Brokerage LLC (“Wealthfront Brokerage”) a member of FINRA/SIPC. Neither Wealthfront Brokerage nor any of its affiliates are a bank, and Cash Account is not a checking or savings account. Wealthfront Brokerage conveys Cash Account funds to depository institutions that accept and maintain such deposits.

Investment management and advisory services are provided by Wealthfront Advisers LLC (“Wealthfront Advisers”), an SEC registered investment adviser, and financial planning tools are provided by Wealthfront Software LLC (“Wealthfront”).

Nothing in this communication should be construed as tax advice, a solicitation or offer, or recommendation, to buy or sell any security. All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Please see our Full Disclosure for important details.

Wealthfront Advisers and Wealthfront Brokerage are wholly owned subsidiaries of Wealthfront Corporation.

© 2019 Wealthfront Corporation. All rights reserved.

About the author(s)

Andy Rachleff is Wealthfront's co-founder and Executive Chairman. He serves as a member of the board of trustees and chairman of the endowment investment committee for University of Pennsylvania and as a member of the faculty at Stanford Graduate School of Business, where he teaches courses on technology entrepreneurship. Prior to Wealthfront, Andy co-founded and was general partner of Benchmark Capital, where he was responsible for investing in a number of successful companies including Equinix, Juniper Networks, and Opsware. He also spent ten years as a general partner with Merrill, Pickard, Anderson & Eyre (MPAE). Andy earned his BS from University of Pennsylvania and his MBA from Stanford Graduate School of Business. View all posts by Andy Rachleff