This post is based on an original post by Andy Rachleff, published on the Wealthfront blog on July 22, 2015. It has been updated based on the recent referendum in the United Kingdom.

Over the last few weeks, the financial news has been filled with predictions of what might occur based on the recent referendum in the United Kingdom. Over the last 24 hours, the financial news cycle has been escalated to a fever pitch based on the results. Overnight market futures dropped significantly in several major markets, including hitting the 5% limit for overnight S&P 500 market futures. The British Pound dropped more than 10%. The Prime Minister has resigned. The FTSE 100 declined 3.15% today, but finished the week up 1.99%. Markets around the world have dropped, recovered and dropped again as analysts and traders work feverishly to find an angle in a changing political environment.

What should an investor do?

In a word: Nothing.

If there’s anything that the day-by-day machinations of the market teach us, it is that slow and steady wins the race.

The Incredible Consistency of Stock Returns

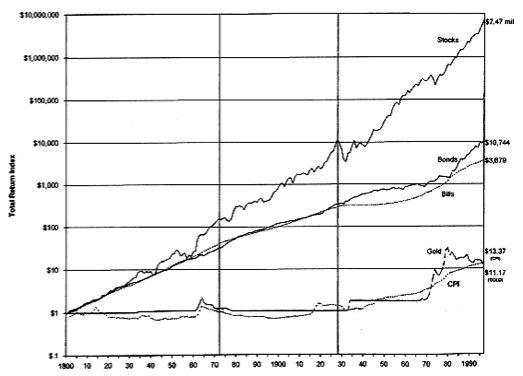

Investors have long known that staying the course is one of the most important things to do. Some of the best research on this topic comes from University of Pennsylvania professor Jeremy Siegel. In his New York Times bestselling book, Stocks for the Long Run, Siegel looked at the performance of equities from 1802 through 1997, the year the book was first published.

His findings were astonishing: Despite the day-to-day volatility that we all feel, the actual long-run returns of stocks are remarkably consistent.

Here’s how he summarized his findings:

“Despite extraordinary changes in the economic, social, and political environment over the past two centuries, stocks have yielded between 6.6 and 7.2 percent per year after inflation in all major subperiods. The wiggles on the stock return line represent the bull and bear markets that equities have suffered throughout history. The long-term perspective radically changes one’s view of the risk of stocks. The short-term fluctuations in market, which loom so large to investors, have little to do with the long-term accumulation of wealth.

His last line bears repeating: The short-term fluctuations in market, which loom so large to investors, have little to do with the long-term accumulation of wealth.

Siegel found that almost no matter what period you looked at, stocks delivered about 7% after inflation. The Civil War, World War I, World War II, even the Great Depression (marked by the second black vertical line) were hiccups compared to the overall trend.

The pattern repeats in other countries, including those that have experienced catastrophic collapses. World War II, for example, sheared 90% off the value of German equities … but German stocks completely rebounded by 1958, rising 30% per year on average from 1948 to 1960. They went on from there to new highs. Averaged out over the long haul, their return is a consistent 6.6% real return … a figure that continues through this day.

The same is true for Japan, the UK, and all other markets that Siegel has studied; in the short-run, volatility, but in the long run, profits.

Can’t We Just Side-Step the Disaster Spots?

Of course, the best possible outcome would be to steer clear of pullbacks, selling when markets are about to collapse and buying when they start to recover. This is the marketing pitch used by virtually every active manager in the world, and it is intuitively compelling.

“The European Union has been a disaster for years,” you can’t help but think. “Surely, if I had been paying attention, I would have sold and avoided the recent turmoil.”

“The polls were showing that this vote might happen. Why wasn’t I prepared?”

Unfortunately, the data shows that even high-paid professionals are bad at sidestepping these pullbacks, and everyday investors are worse.

As mentioned repeatedly on this blog, every piece of significant data shows that the vast majority of active mutual fund managers underperform the market over any meaningful period of time. Despite all their high-paid analysts and fancy data services, they can’t beat a broad-based index.

But the dirty little secret is, as bad as professional money managers are at beating the market, retail investors – on average – do worse.

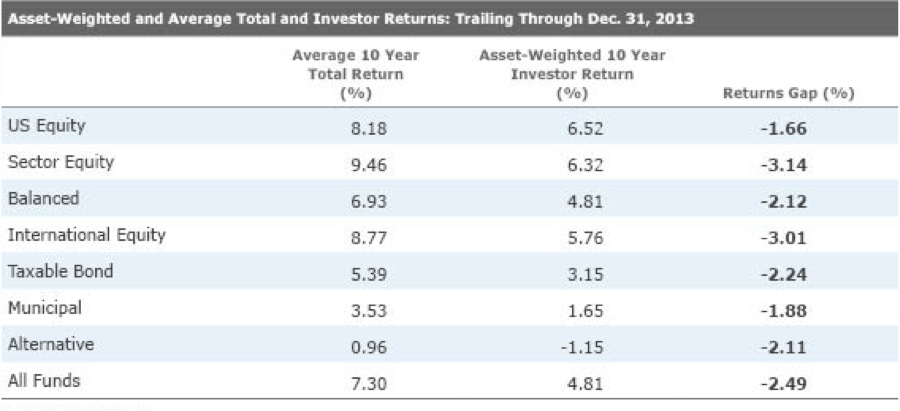

In a major study published in February 2015, Morningstar looked at the difference between the average return of mutual funds and the actual returns that investors enjoyed. The data is brutal: While the average U.S. equity mutual fund returned 8.18% for the decade ending December 31, 2013, the average dollar invested in U.S. equity funds returned just 6.52%. For international equity funds, the situation was worse: an 8.77% return for the average fund, but a 5.76% return for investors.

John Rekenthaler, the vice president of research at Morningstar, explained what was happening in Barron’s last year. “The problem,” the magazine wrote, summarizing his comments, “is that investors tend to get in and out of an asset class at the wrong time.”

In other words, we tend to buy high and sell low. The problem is worse in the more volatile asset classes, ostensibly because we’re more likely to panic.

[It’s not just Morningstar. DALBAR conducts an annual study that looks at the same effect over rolling twenty-year periods. Its last finding shows that investors underperformed the market by 4.2% per year over the past twenty years.]

Don’t Buy What They’re Selling

The reason we don’t hear much about the power of long-term investing – and the truth about the futility of trading – is that long-term investing is boring and it’s cheap. The financial media thrives by encouraging you to panic, and large parts of the financial industry make money only when you act. Big moves sell newspapers, and high trading activity means commissions for online brokers. The only people who don’t profit from that activity are investors themselves, because as it turns out, we can’t predict the future.

Even as we finalize this post, markets are stabilizing, politicians and economists are projecting that the ramifications of this vote will likely play out over the next few years. Markets may fall next week, or they may recover. No one can be sure for certain, but the overwhelming evidence is that most of the people who try to trade based on their predictions will underperform those who stick to a prudent, low-cost and diversified long term strategy.

It’s hard to stare down a significant market correction and stick to your plan. When the US government shut down in September 2013 during the budget showdown, we saw a large number of clients refrain from continuing to add deposits. They paid handsomely for that mistake by missing out on the rebound. If you invest regularly, harvest your losses and rebalance your portfolio, you’ll end up benefiting from market corrections in multiple ways.

It won’t be easy. But over the long haul, it will likely pay off.

For more on this topic please read:

- Stay the Course, Even While You’re Down

- There’s No Need to Fear Stock Market Corrections

- Invest Despite Volatility

Disclosure

Nothing in this article should be construed as a solicitation or offer, or recommendation, to buy or sell any security. The information provided here is for educational purposes only and is not intended as investment advice. The analysis uses information from third-party sources, which Wealthfront believes to be accurate; however Wealthfront does not guarantee the accuracy of the information. There is a potential for loss as well as gain in investing. Wealthfront does not provide personalized financial planning to investors, such as estate, tax, or retirement planning. Financial advisory services are only provided to investors who become Wealthfront Clients (“Clients”) pursuant to a written Client Agreement, which investors are urged to read and carefully consider in determining whether such agreement is suitable for their individual facts and circumstances.

About the author(s)

The Wealthfront Team believes everyone deserves access to sophisticated financial advice. The team includes Certified Financial Planners (CFPs), Chartered Financial Analysts (CFAs), a Certified Public Accountant (CPA), and individuals with Series 7 and Series 66 registrations from FINRA. Collectively, the Wealthfront Team has decades of experience helping people build secure and rewarding financial lives. View all posts by The Wealthfront Team