When you’re building long-term wealth, compounding can help you get there faster by increasing the rate at which your money grows. Understanding compounding is key to achieving your long-term financial goals, so in this post, we’ll tell you exactly what you need to know.

What is compounding?

Compounding is the name for when your earnings are reinvested over time so they can earn money, too. Interest can compound (this is called “compound interest”) and so can investment returns (“compound returns”). In both cases, compounding can make your initial deposit or investment grow much faster than it would if your earnings were not reinvested.

Why is compounding important when building wealth?

Compounding can have a dramatic effect on your wealth over time. The longer your time horizon, the larger the impact.

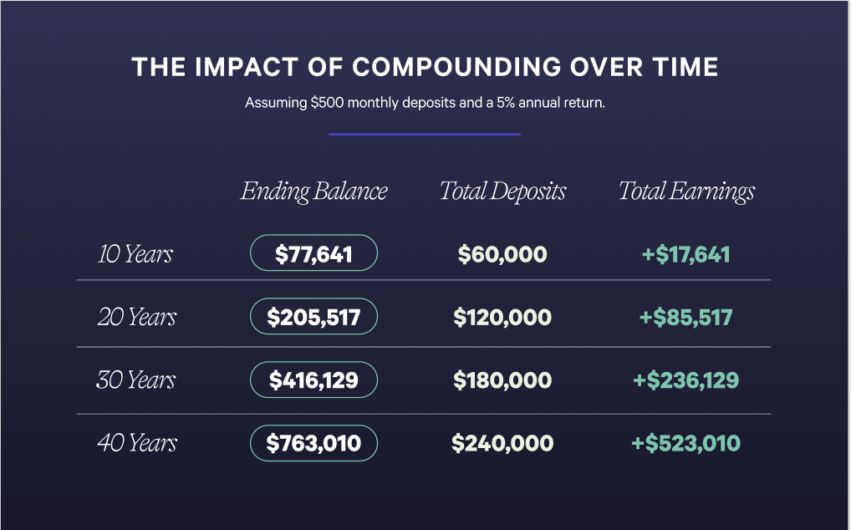

This is best illustrated with a quick example. Let’s say you’re saving for retirement and save $500 each month. The table below shows how much your savings would grow over time, taking into account the impact of a 5% annual return and monthly compounding.

As you can see, the earlier you start taking advantage of compounding, the more you benefit. If you save $500 a month for 30 years, you’ll have $416,129.32 by retirement, $236,129.32 of which is earnings. Starting earlier is even better: if you save $500 each month for 40 years, by the time you retire you’ll have a staggering $763,010.08, over half a million of which ($523,010.08) is earnings. As this example demonstrates, compounding is a powerful way of growing your savings faster over time.

What is compound interest?

Compound interest is the interest you earn on your original investment plus the interest you earn on your interest. You can earn compound interest in an interest-bearing account like the Wealthfront Cash Account or on a bond.

Interest can compound (or get added to your original deposit and start earning interest itself) on different schedules—daily, monthly, etc. The more frequently your interest compounds, the more interest you’ll earn.

The difference between compound interest and simple interest

Most interest-bearing accounts pay compound interest, but there’s a second kind of interest you should understand: simple interest. When you earn simple interest, your interest doesn’t earn interest. The easiest way to see the difference between simple and compound interest is with an example.

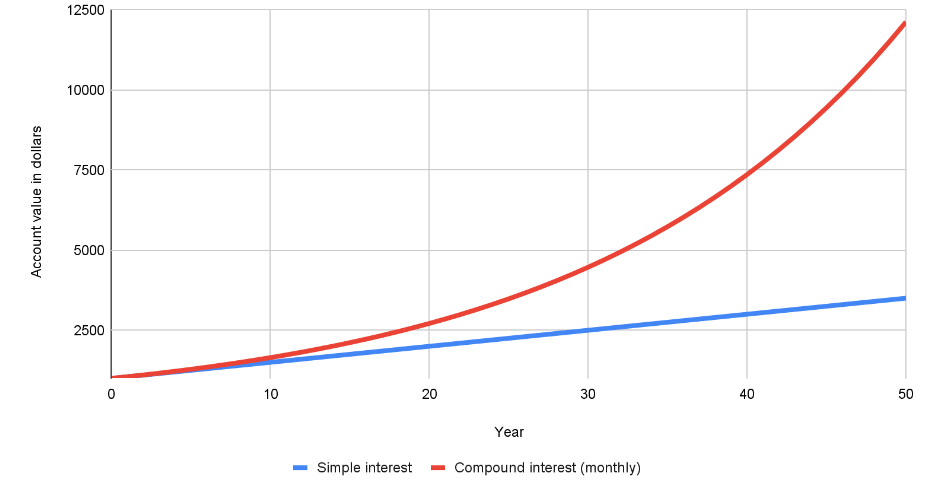

Let’s say you put $1,000 into an account with 5% simple interest. After 50 years, your $1,000 earning 5% interest would be worth $3,500. But if you earned compound interest (assuming monthly compounding), it would be worth $12,119.38 after 50 years—over three times as much.

Value of $1,000 over 50 years with 5% interest

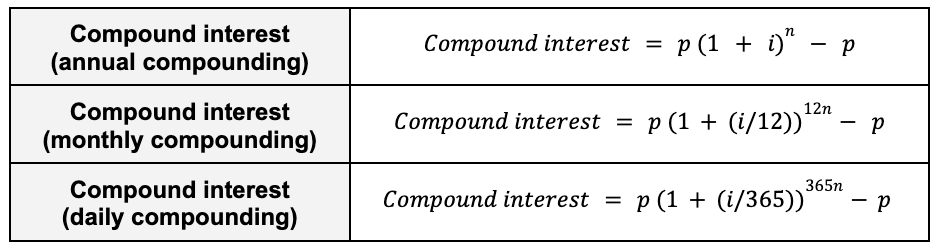

How to calculate compound interest

The table below shows you how to calculate compound interest, assuming you don’t make any add-on deposits or withdrawals. Just plug in the principal (that’s your starting amount, designated with a “p”), annual interest rate (“i”), and time horizon (“n” is number of years).

There are also many online calculators you can use to do the math, like this one from Investor.gov.

The pros and cons of compound interest

The obvious benefit of compound interest is that it helps your savings grow faster. But when you owe someone money and you’re paying compound interest on the loan, compounding works against you. Credit card debt, for example, often compounds daily. The good news is that two common kinds of debt, mortgages and student loans, generally have simple interest.

What are compound returns?

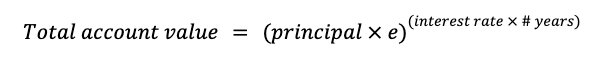

If you invest using a taxable investment account like a Wealthfront Investment Account or a retirement account like a Wealthfront IRA, you can earn compound returns. You probably already know that when you buy an investment (like a stock, bond, or index fund) and the value of that investment increases, you earn returns. You may not know that these returns compound over time in much the same way that compound interest does, as long as you leave your earnings invested. However, unlike interest that compounds on a set schedule, investment returns generally compound continuously. You can calculate the impact of continuous compounding using the formula below:

Rule of 72

The “rule of 72” is a rule of thumb that helps you calculate how long it will take your investment to double in value, taking into account the impact of compounding and assuming you don’t add to your investment. Just take the number 72 and divide it by your annual return (expressed as a percentage). The resulting number tells you roughly how many years it will take your investment to be worth twice as much.

For example, let’s say you expect your investment to have a 8% rate of return each year. 72 divided by 8 is 9. Your investment will take about 9 years to double in value.

Time value of money

Intuitively, you probably know it’s better for someone to give you $100 today than $100 in five years (even ignoring the impact of inflation). That’s because if someone gives you $100 today, you can invest it so it’s worth more in the future. This concept is known as the time value of money. But what if someone offers you $100 now or $120 in five years?

You can use the formula below to calculate what a sum of money today will be worth in the future if you invest it, taking into account the impact of continuous compounding.

In the case of the example above, if you could earn an 8% annual rate of return for those five years, you’d much rather have $100 today because its future value is $149.18.

The bottom line

If you’re building wealth, compounding works to your advantage. Just start saving (or investing) as early as possible so you can give your money the maximum amount of time to grow. You can earn compound interest in a Wealthfront Cash Account, or let your investment returns compound in a Wealthfront Investment Account (or Wealthfront IRA, if you’re saving for retirement). When you invest with Wealthfront, we automatically reinvest your dividends so those earnings will compound without any extra effort.

Disclosure

The information contained in this communication is provided for general informational purposes only, and should not be construed as investment or tax advice. Nothing in this communication should be construed as a solicitation, offer, or recommendation, to buy or sell any security. Any links provided to other server sites are offered as a matter of convenience and are not intended to imply that Wealthfront Advisers or its affiliates endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Investment management and advisory services–which are not FDIC insured–are provided by Wealthfront Advisers LLC (“Wealthfront Advisers”), an SEC-registered investment adviser, and financial planning tools are provided by Wealthfront Software LLC (“Wealthfront”). Brokerage products and services are offered by Wealthfront Brokerage LLC, member FINRA / SIPC. All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Please see our Full Disclosure for important details.

Wealthfront Advisers, Wealthfront Brokerage and Wealthfront are wholly owned subsidiaries of Wealthfront Corporation.

Copyright 2022 Wealthfront Corporation. All rights reserved.

About the author(s)

Tony Molina is a Product Evangelist at Wealthfront. He is a Certified Public Accountant (CPA) and holds Series 66 and Series 7 licenses from FINRA. View all posts by Tony Molina, CPA