In real estate, the three most important factors are location, location, location. Location is a surprisingly important consideration in investing, too, though I can’t boil it down to an aphorism.

Asset Location

What I mean by location in this context is Asset Location, or how you should distribute different asset classes across your taxable and retirement investment accounts to minimize the taxes you pay across all your holdings.

Traditionally, asset location has been done by segregating tax-inefficient asset classes (generally those that produce income taxed at ordinary income tax rates, such as REITs and taxable bonds) into retirement accounts, and tax-efficient asset classes (those with lower tax rates) into taxable accounts. This is a pretty simple approach to reducing taxes for most investors and therefore has been widely implemented.

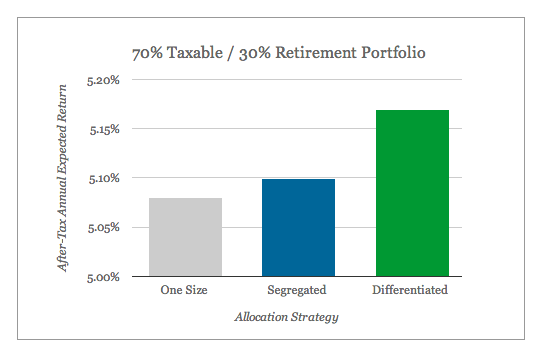

However our analysis, illustrated below, suggests that differentiated asset location leads to higher after-tax returns for investors who hold the majority of their assets in taxable accounts, as many young investors who work in tech do.

Differentiated asset location differs from segregated asset location in that it focuses on calculating allocations that deliver the best after-tax returns for each type of account – be it retirement or taxable. To make decisions about differentiated asset location, we consider the tax characteristics of an asset class, its potential for risk-adjusted return, and the way it balances the risks of the other asset classes in the account. In other words the allocation is not solely based on tax efficiency or inefficiency.

Differentiated asset allocation is also more practical to implement over time, because it is easier for investors to change their allocations in the different types of accounts as their goals for each account change.

What is Asset Location Worth?

Our estimated incremental annual benefit from asset location ranges from 0.10-0.50%, depending on the underlying assumptions made around taxes, expected investment returns and time horizon. An increase of 0.10-0.50% in your annual returns may not sound like much, but it can be meaningful when you compound it over many years.

An Illustrative Example

We implemented differentiated asset location in March, with our new investment mix. Here, we are sharing the analysis that explains why differentiated asset location is better for your overall portfolio than segregated asset location in cases where your taxable assets represent more than 50% of your total net worth.

To understand the analysis, let’s start with our assumptions for nine widely used asset classes’ pre-tax expected annual (nominal) return. We then translate the returns into after-tax expected returns, which assume the investors are in high-tax states. All estimates are expressed net of ETF fees (see Table 1[1]).

| Asset Type | Pre-tax Net-of-Fee Expected Annual Return | % Return from Appreciation | Annual Return from Appreciation | Annual Return from Dividends & Interest | After-tax Expected Return |

|---|---|---|---|---|---|

| US Stocks | 6.5% | 75% | 4.9% | 1.6% | 5.4% |

| Foreign Stocks | 7.2% | 75% | 5.4% | 1.8% | 6.0% |

| Emerging Markets | 8.8% | 75% | 6.6% | 2.2% | 7.4% |

| Dividend Stocks | 5.4% | 50% | 2.7% | 2.7% | 4.2% |

| Natural Resources | 4.7% | 100% | 4.7% | 0.0% | 4.2% |

| Real Estate | 6.3% | 50% | 3.2% | 3.2% | 4.4% |

| Municipal Bonds | 1.1% | 0% | 0.0% | 1.1% | 1.0% |

| Corporate Bonds | 1.6% | 0% | 0.0% | 1.6% | 0.8% |

| Emerging Mkt Bonds | 2.8% | 0% | 0.0% | 2.8% | 1.4% |

We feed these assumptions into a mean variance optimization framework to calculate optimal asset allocations for various mixes of taxable and retirement assets using different asset location approaches. We chose to evaluate three asset location approaches: (1) segregated asset location (2) differentiated asset allocation and (3) an approach that specifically does not optimize for asset location (i.e. a one-size-fits-all account types allocation). For the segregated asset location scenario we assumed investors always put REITs in their retirement accounts first, followed by Taxable Bonds (Emerging Market Bonds and Corporate Bonds in this example) and then any Equities when necessary. To simplify the analysis, we assumed the investor has the risk profile of an average Wealthfront client (i.e. risk score of 7). Applying these allocations, we can calculate the overall after-tax returns for an investor with various mixes of taxable and retirement assets.

The two takeaways from this analysis are:

1. Differentiated asset location will drive the highest after-tax expected returns if you have more than 50% of your net worth in your taxable account. Segregated asset location will drive the highest after-tax return if you have less than 50% of your net worth in your taxable account.

2. The relatively low current expected return environment suggests any approach to asset location is currently worth on the low-end of the 0.10%-0.50% range. It is likely to be worth the low end of the range today and the high end of the range as expected returns increase.

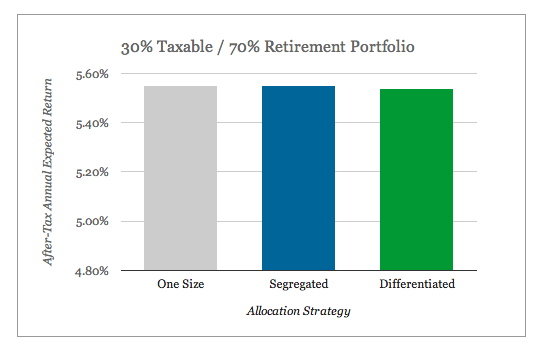

In the charts below, you can see that investors with a 70% taxable/30% retirement mix[2] earn a higher return using differentiated asset location and investors with a 30% taxable/70% retirement mix earn a slightly higher (0.01%) return using segregated asset location. (The difference grows as the imbalance between retirement and taxable assets grows — for instance, in a 90/10 mix or a 10/90 mix.)

Why Wealthfront Uses Differentiated Asset Location

Most of our clients at Wealthfront tend to be younger and have the majority of their net worth in taxable accounts, so differentiated asset location is generally the better strategy for them.

Differentiated asset location also has two additional practical benefits over segregated asset location. Differentiated asset location will be easier to manage over time as the relative amounts between your taxable and retirement accounts evolve. You simply rebalance each account to the desired allocation for the account. Differentiated asset location provides more diversified portfolios at the account level, which may help if you need liquidity from a specific account on short notice.

As a software-based financial advisor we strive to improve our investment service relentlessly over time. We may well offer segregated asset location as our client base broadens. You can be sure it’s on our product roadmap and will become a valuable option for many of our clients.

The Bottom Line

Asset location is a yet another example of an investment method that is not well understood and therefore inappropriately applied the same way across all clients.

As we have shown, the traditional approach to asset location, segregating asset classes by account type, is not the best approach for people with less than half their assets in retirement accounts. We take on the conventional wisdom whenever we can – as we have in posts about why you should not max out your 401(k), invest directly in real estate or buy whole life insurance.

At Wealthfront we are dedicated to using data, not conventional wisdom and rules of thumb, to drive our investment decisions. We hope you’ll make a habit of reading out posts for more of the advice you need.

[1] Please note this is just one example. If you use different assumptions you will get different results. Our estimates are based on the estimates explained in our investment methodology white paper.

[2] The table below displays the specific optimized asset allocations for each asset location approach for the 70% taxable and 30% retirement scenario.

| One Size Fits All | 70/30 Segregated | 70/30 Differentiated | |||

|---|---|---|---|---|---|

| Asset Class | Taxable & Retirement | Taxable Account | Retirement Account | Taxable Account | Retirement Account |

| US Stocks | 25% | 36% | 0% | 35% | 20% |

| Foreign Stocks | 20% | 29% | 0% | 20% | 17% |

| Emerging Markets | 15% | 21% | 0% | 15% | 14% |

| Dividend Stocks | 5% | 7% | 0% | 7% | 15% |

| Natural Resources | 5% | 7% | 0% | 5% | 0% |

| Real Estate | 10% | 0% | 33% | 0% | 13% |

| Municipal Bonds | 0% | 0% | 0% | 18% | 0% |

| Corporate Bonds | 15% | 0% | 50% | 0% | 13% |

| Emerging Mkt Bonds | 5% | 0% | 17% | 0% | 8% |

| 100% | 100% | 100% | 100% | 100% | |

Disclosure

Nothing in this blog should be construed as tax advice, a solicitation or offer, or recommendation, to buy or sell any security. Financial advisory services are only provided to investors who become Wealthfront Inc. clients pursuant to a written agreement, which investors are urged to read carefully, that is available at www.wealthfront.com. All securities involve risk and may result in some loss. For more information please visit www.wealthfront.com or see our Full Disclosure. While the data Wealthfront uses from third parties is believed to be reliable, Wealthfront does not guarantee the accuracy of the information.

We simulated the potential after-tax benefit of our updated, more diversified asset allocation in a taxable account using historical results averaged across different risk levels and found that it added an average of 0.5% annually. These results are based on an analysis Wealthfront conducted where the parameters included long term expected return, correlation and standard deviation for 11 asset classes. We assumed a Wealthfront account with an initial deposit of $100,000, with no subsequent deposits, and no tax-loss harvesting. Dividends, interest and advisory fees were considered.

We assume the 0.5% annual additional return from our simulation is reinvested back into the Wealthfront portfolio with the updated, more diversified asset allocation over a 20-year period. We compared this portfolio to the original Wealthfront asset allocation, both starting with $100,000, compounded over 20 years using the assumptions described above. The estimated difference between the two portfolios at the end of the 20 years was approximately $28,000.A different methodology would result in different outcomes. For example, we assume that an investor’s risk profile and target allocation mix would not have changed during the time period and that any material economic and market factors that might have occurred during the time period would not impact client decision-making. However, actual investors may have experienced changes to their allocation mix in response to changing suitability profiles and investment objectives. Actual investors on Wealthfront will experience different results from the results shown. There is a potential for loss as well as gain that is not reflected in the hypothetical information presented.

Hypothetical performance is not an indicator of future actual results. Hypothetical results are calculated by the retroactive application of a model constructed on the basis of historical data and based on assumptions integral to the model which may or may not be testable and are subject to losses. Wealthfront assumed we would have been able to purchase the securities recommended by the model and the markets were sufficiently liquid to permit all trading. Hypothetical performance is developed with the benefit of hindsight and has inherent limitations. Specifically, hypothetical results do not reflect actual trading or the effect of material economic and market factors on the decision-making process. Actual performance may differ significantly from hypothetical performance. There is a potential for loss as well as gain that is not reflected in the hypothetical information portrayed. Investors evaluating this information should carefully consider the processes, data, and assumptions used by Wealthfront in creating its historical simulations.

About the author(s)

As Wealthfront's Vice President of Research, Jeff Rosenberger manages investment research, customer development and the Wealthfront seminar program. Prior to Wealthfront, Jeff worked in enterprise software with two startups, one of which, ProfitLogic, was acquired by Oracle in 2005. Prior to earning his PhD in Management Science & Engineering from Stanford University, Jeff worked briefly at Deloitte Consulting and Salomon Brothers. Jeff earned MS degrees in Operations Research and Statistics from Stanford University and BA from UC Berkeley. View all posts by Jeff Rosenberger, PhD