One of the most common questions posed to our client services team is “What is the expected long-term rate of return I can assume if I invest in a diversified portfolio?”

Based on return estimates derived from the market (not Wealthfront’s opinion), an optimally diversified portfolio of low-cost index funds is expected to generate an annual long-term pre-tax return of 4% – 6%, depending on how much risk you are willing to tolerate. It should be noted that the returns achieved over the past two years were much higher, but as you know past returns are not indicative of future returns.

Returns Are Almost Impossible to Predict

Some of you might be disappointed with this expected long-term return. I wish it were higher, but to be honest, it doesn’t really matter what we think the expected return is likely to be because the only thing we can be sure of is that we can’t predict it. That’s the fundamental premise of our investment methodology. For more than 40 years, our Chief Investment Officer, Burt Malkiel, has been telling investors that you can’t control the market, so you should focus your energy on the three things you can control: diversifying your portfolio, minimizing your fees and minimizing your taxes. For this reason we recommend a diversified portfolio of low-cost index funds and, where appropriate, you should tax-loss harvest.

A Passive Portfolio Generates a Market Return

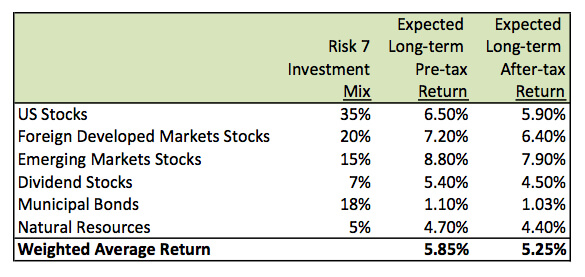

A portfolio of index funds will deliver a return equal to the weighted average return of each of its component asset classes. It will never outperform and never under perform. We use mean variance optimization to determine the ideal mix of asset classes that can be expected to generate the highest after-tax return for every level of risk (as defined by the volatility of your portfolio). The inputs into the optimizer are the expected after-tax return of each asset class, the expected volatility of each asset class and the covariance among asset classes. In order to avoid imposing our opinion on the outcome, we use the expected returns implied by the capital asset pricing model (in other words the expected returns embedded in the current pricing of marketable securities), volatility implied by the option market and a mix of long- and short-term observed covariance. We never try to underweight or overweight a particular asset class in your investment mix based on how expensive or cheap it might appear because years of research has shown that it is almost impossible to predict which asset classes will likely outperform in the future.

For more than 40 years, our Chief Investment Officer, Burt Malkiel, has been telling investors that you can’t control the market, so you should focus your energy on the three things you can control: diversifying your portfolio, minimizing your fees and minimizing your taxes.

Our recommended diversified portfolios attempt to maximize the return you can expect for every level of risk. In other words combining relatively uncorrelated asset classes like stocks, bonds, real estate and natural resources will serve to reduce your portfolio’s overall volatility for every level of risk. It doesn’t attempt to outperform a particular benchmark. Keep in mind that a diversified portfolio will always underperform the top performing asset class each year. Please read that again. Diversified portfolios are not going to generate the best return among all your alternatives in the short term. However a diversified portfolio of low-cost index funds should outperform all individual asset classes on a risk-adjusted-return basis over the long term (i.e. more than 10 years).

Taxes Make a Big Difference in Your Realized Return

The table below displays our recommended asset allocation for our average client (one with a risk tolerance of 7 on a scale of 0 to 10):

We focus on after–tax returns because, unlike institutions, every individual investor must pay taxes. Therefore only your after-tax return is relevant. Our sole focus on after-tax returns makes it very difficult to compare Wealthfront’s return to other investment advisors because pre-tax return is the standard way for investment advisors to report their returns. As a result we may look worse on a pre-tax basis, but better on the non-reported after-tax basis.

Let me illustrate with a couple of examples. Wealthfront uses municipal bonds for your fixed income allocation in its taxable accounts. Municipal bonds pay a lower interest rate than corporate bonds, but generate a higher after-tax interest rate due to not being subject to federal and often state tax. Therefore a Wealthfront taxable portfolio with municipal bonds will have a lower pre-tax return, but a higher after-tax return than a portfolio with corporate bonds (see Why Should I have Bonds in My Portfolio? and Municipal Bonds Belong in Your Taxable Portfolio for more information).

We focus on after–tax returns because, unlike institutions, every individual investor must pay taxes.

The use of real estate index funds creates another confusing situation. Dividends on Real Estate Investment Trusts (REITs), the most common way to publicly invest in real estate, are taxed at a much higher rate than common stock dividends and REIT dividend yields are often higher than common stock dividend yields. Therefore a taxable portfolio that includes REITS will likely have a higher pre-tax return than a portfolio that excludes them, but a lower after-tax return due to the tax inefficiency of REIT dividends. For this reason we limit our investment in REITs to our clients’ retirement accounts that don’t pay taxes (for more details on this please see Why You Should Exclude REITs From Taxable Accounts).

These asset location examples are just one of the seven ways Wealthfront minimizes the taxes associated with your investment account. We believe we offer more ways to minimize your taxes than any other automated investment service or traditional investment advisor. For a detailed explanation of why please see Minimize Your Investment Taxes.

The different focus among advisors regarding taxes makes it almost impossible to compare performance on an apples-to-apples basis. You’ll even notice that despite our focus on after-tax returns I quoted the expected pre-tax return of a diversified portfolio in the second sentence of this post because of industry convention.

Alternative Asset Classes Could Increase Your Returns

It is theoretically possible to earn a higher pre-tax and after-tax portfolio return than that which is possible through Wealthfront, but you would need access to the premier alternative asset classes like hedge funds, private equity and venture capital. In fact many private wealth managers tout their ability to provide access to such alternative assets, the alternatives you can access through private wealth managers are highly likely to underperform a diversified portfolio of low cost index funds. Typically only very larger endowments and very wealthy families are able to gain access to the alternative managers who can increase your portfolio’s overall after-tax return.

It’s Really Difficult to Compare Investment Advisors

By now I hope you can see how difficult it is to compare investment advisors based on their reported performance. In The Challenge: How To Benchmark Your Investment Portfolio, I explained that the best measure to evaluate a portfolio is its net-of fee, after-tax risk-adjusted return. Unfortunately no one reports such a number because the SEC doesn’t require it (probably because they assume most individual investors won’t understand it). However, you can tell if it’s important to your investment advisor if she highlights it in the material that describes her investment approach. We certainly do in our investment methodology white paper.

The optimal investment approach described in this post cannot be evaluated on short-term results. That’s because short-term perturbations in the financial markets can make a portfolio of market-tracking index funds look better or worse than they really are. Unfortunately that makes it really hard to evaluate your investment advisor in the short-term. As an alternative to looking at short-term results, I recommend evaluating an index fund oriented investment advisor based on the quality of value added services they claim and whether they in fact execute what they claim. In other words have they done the best possible job diversifying your portfolio, minimizing fees and minimizing your taxes? If you come across someone who promotes long-term expected annual pre-tax returns in excess of 6% – 7% then I would run in the opposite direction because it is highly unlikely.

Disclosure

The information contained in the article is provided for general informational purposes, and should not be construed as investment advice. This article is not intended as tax advice, and Wealthfront does not represent in any manner that the outcomes described herein will result in any particular tax consequence. Prospective investors should confer with their personal tax advisors regarding the tax consequences based on their particular circumstances. Wealthfront assumes no responsibility for the tax consequences to any investor of any transaction. Financial advisory services are only provided to investors who become Wealthfront clients. Past performance is no guarantee of future results.

About the author(s)

Andy Rachleff is Wealthfront's co-founder and Executive Chairman. He serves as a member of the board of trustees and chairman of the endowment investment committee for University of Pennsylvania and as a member of the faculty at Stanford Graduate School of Business, where he teaches courses on technology entrepreneurship. Prior to Wealthfront, Andy co-founded and was general partner of Benchmark Capital, where he was responsible for investing in a number of successful companies including Equinix, Juniper Networks, and Opsware. He also spent ten years as a general partner with Merrill, Pickard, Anderson & Eyre (MPAE). Andy earned his BS from University of Pennsylvania and his MBA from Stanford Graduate School of Business. View all posts by Andy Rachleff