CHEERS TO

Taking control of your debt

Having debt can not only feel uncomfortable, it can also hold you back from reaching other financial goals. We recommend the following steps to get a better handle on your loans:

- Know your interest rates

- Evaluate the trade-off between paying down and saving more

- Refinance your outstanding loans

Know your interest rates

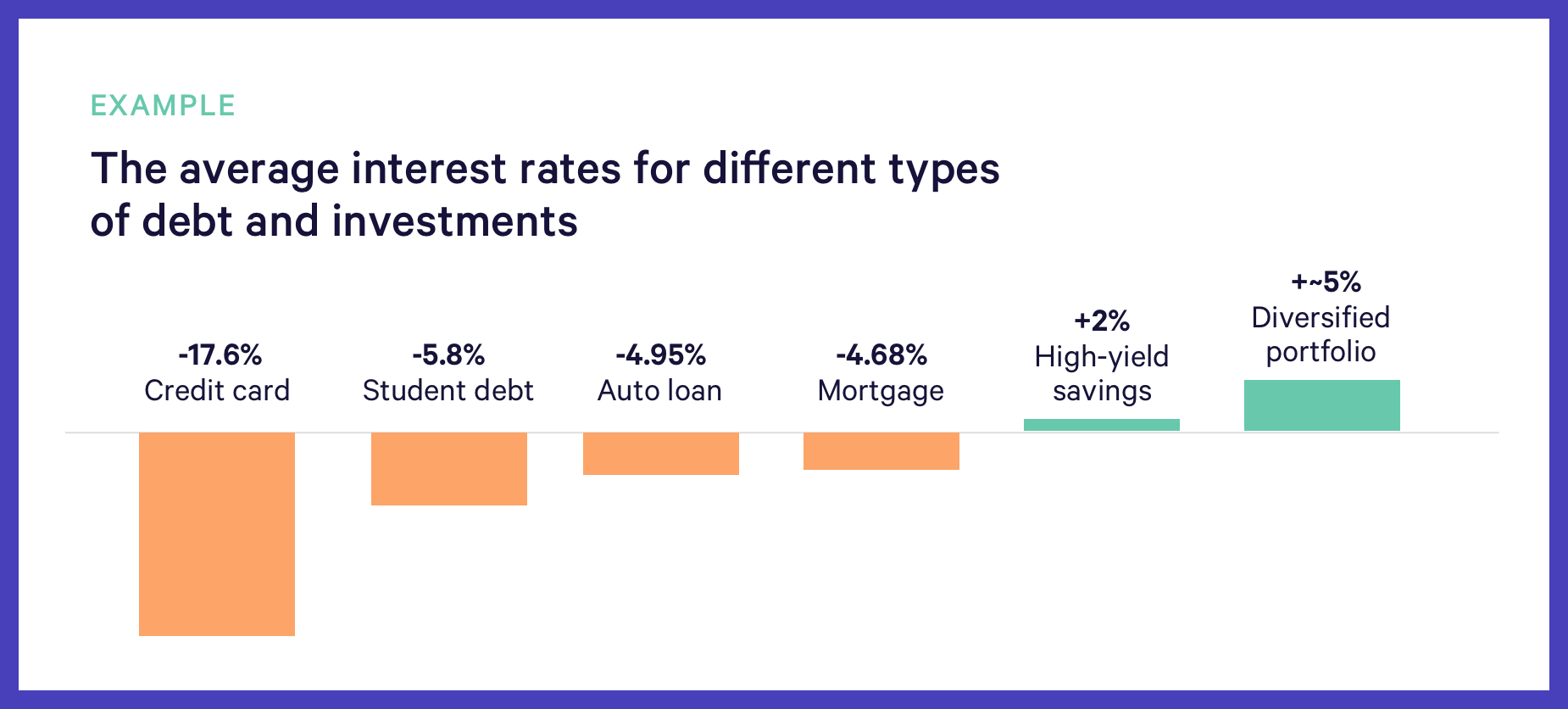

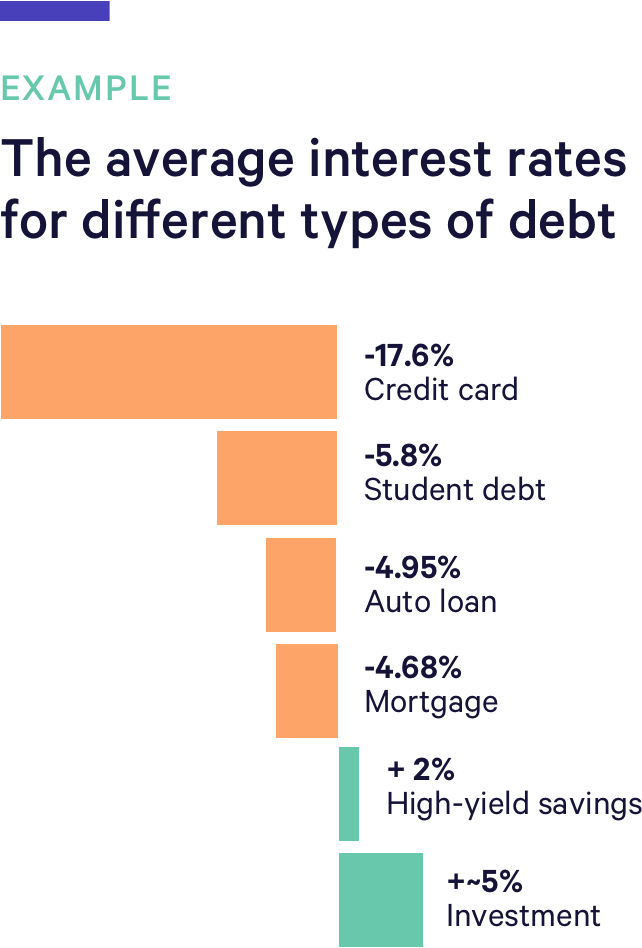

The first step in tackling your debt is to know the interest rates on every loan you hold. The interest is what you pay on top of your principal, or the cost of borrowing money from your lender. Here are the average interest rates for the most common types of debt and investments:

Source: Bankrate and Nerdwallet

To be clear, all credit card debt should be paid off every month. Given the high interest associated with it, you'll always be losing out by holding on to that debt. After you have your credit cards in order, prioritize paying down other high interest rate loans first.

For student loans: the interest rate could vary from 2% to more than 10% depending on the type of loan (federal or private), whether they're from undergrad or grad school, and what year you took them out. If you're holding loans with a fixed rate of less than 5%, that may be favorable given the current student loan interest rates. But if you have a fixed rate that's greater than 5%, you may want to consider refinancing your student loans. We address the key considerations of refinancing student loans in a later section. Read more →

Decide between paying down your debt vs. saving more cash

The eternal question: If you have extra cash available but are still sitting on debt, should you prioritize paying down your loan or adding to your cash savings or investments? To examine this allocation fork in the road, let's walk through a few common scenarios. (For simplicity, the following all assume a reasonable 5% return per year on the investments being considered.)

The Situation

The after-tax interest rate on your student loan is less than 5%.

The Best Bet

In this case, investing your extra savings may pay off more in the long run, but this decision has risk. Loans with a fixed interest rate lower than 6% may be worth keeping given their after-tax interest rate could be lower than the rate you could earn on a diversified portfolio. For someone who qualifies to deduct their interest and has a tax rate of 25%, the after-tax rate on a 6% student loan would be 4.5% (6% x (1 - 25%)). If your expected return is much higher than your loan’s after-tax interest rate, then you should invest the money. But if the return on the diversified portfolio is only slightly higher, you might be better off paying down your loan. Market risks in the near-term make returns impossible to guarantee, but the money you'll save by putting the money toward your loan — thereby avoiding extra interest — is guaranteed.

The Situation

You have credit card debt.

The Best Bet

This is an easy starting point — all credit card debt should be paid off every month if possible. No investment opportunity is likely to yield returns that outsize the interest you're paying on a credit card, meaning you will always lose out by holding on to that debt. After you have your credit cards in order, prioritize paying down other high interest rate loans.

The Situation

The after-tax interest rate on your mortgage is lower than the expected return on an investment you're considering.

The Best Bet

Invest the money. Unless you just hate having any kind of debt, a mortgage is an incredibly cost-effective way to pay for your home.

The Situation

You don't yet have an emergency fund (or not enough of one)

The Best Bet

Figuring out how to build the right emergency fund for you hinges on countless individual factors. But if you don’t have a comfortable emergency stash, it's a good idea to prioritize that over paying down debt and investing. Just for a while! Think of it this way: If you don't have an emergency fund and suddenly lose your job, you could end up going into more debt. There are enough worries to steal your sleep — don’t deny yourself the peace of mind of having a cash cushion before tackling anything else, just in case.

The good news here

If you still need to stick some of your cash into an emergency fund before investing, it doesn't have to sit around earning no interest. Not all cash accounts are the low-interest bummer they used to be. FDIC-insured Wealthfront Cash Accounts, for example, hook you up with an interest rate of 5.00%.

Consider refinancing your loans

Refinancing your loans can reduce your interest rate and shorten the time it takes to pay off the debt, which can translate to significant savings for you. Many people are familiar with refinancing in the context of mortgages, but it has become a more common practice for those with high-interest student loans as well.

If you're evaluating refinancing student loans

Consider more than just the interest rate. If you want to refinance Federal student loans, you may be sacrificing some important benefits, like income-based repayment or the Public Service Loan Forgiveness program.

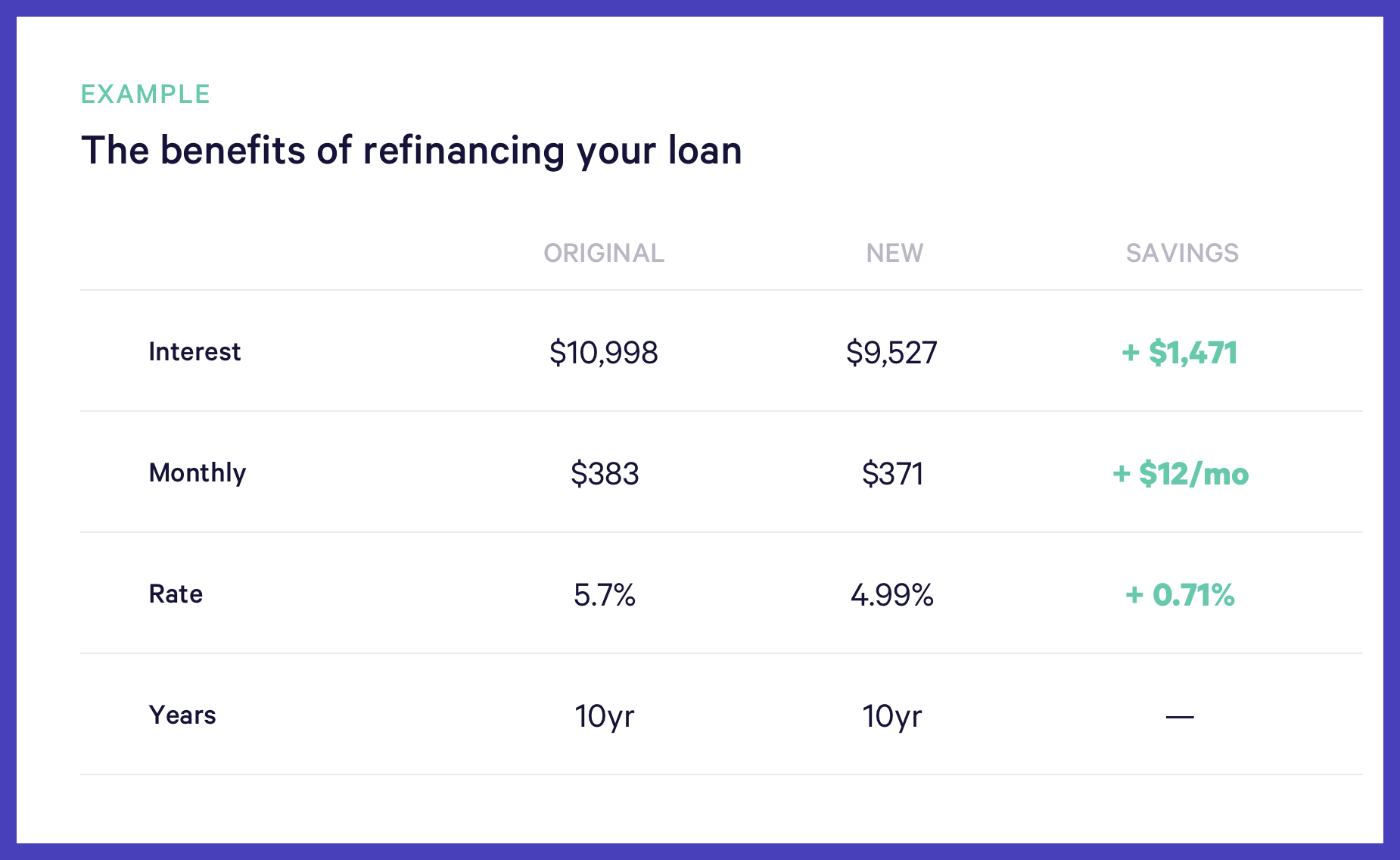

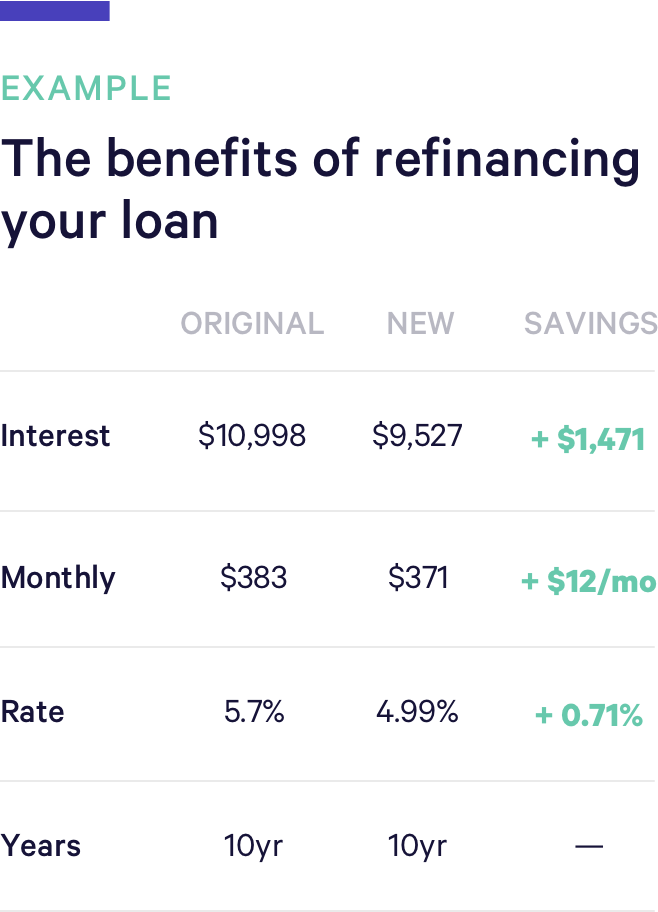

The financial impact of refinancing will depend on your interest rate, total principal balance and loan term. The example below shows how someone can save $1,471 by reducing their interest rate by just 0.71%.

Source: Student Loan Hero.

So depending on the size of your loan and your current interest rate, refinancing your student loans could lead to meaningful total savings over the life of your loan.

More resources

TO SUM IT UP

Tackling your debt starts with knowing your interest rates and prioritizing which loans to pay down first. While you may want to begin investing extra savings instead of paying off debt, understand the risks that comes with this choice. And if you think you can get a better interest rate, look into refinancing your loans.

Dive into another question →