If you work at a company that’s recently gone public, you might be tempted to take up angel investing. And if you’re going to do that, it’s important to be familiar with the tax treatment of certain investments known as qualified small business stock, or QSBS. If you own QSBS, you can exclude up to $10 million of capital gains from your federal tax liability.

This is very attractive on its own, but many people don’t realize that paying zero federal tax on $10 million could be just the beginning. We’ll use a baseball analogy to demonstrate exactly how this works. If saving federal tax on $10 million is like hitting a single in baseball, what can you do with a double, a triple, or even a home run? Read on to learn more about how to take advantage of this powerful tax benefit.

What is QSBS?

Let’s start with the basics. Introduced in 1993 as Section 1202 of the Internal Revenue Code (IRC), QSBS permits a partial exclusion on qualifying gains. The law evolved over time, but it became more exciting in September 2010 when changes were made that eliminated the federal tax on qualifying sales.

QSBS has been a great opportunity for years, and people are becoming more aware of it. And while this tax-free benefit is currently available, it could potentially change if federal and state tax rates rise, or if changes are made to tax law. Many people never look beyond the basic federal benefits for QSBS and miss out on the potential estate and gift and state savings opportunities.

How to qualify for QSBS

Here are five general requirements (among many) to consider when determining whether you can qualify for QSBS tax benefits:

1. In order to qualify for 100% exclusion, the stock must have been purchased from a domestic C corporation at original issuance after September 27, 2010. (Shares you bought from another investor don’t qualify.)

There are two other levels of potential gain exclusion:

- 50%, if you purchased the stock before February 18, 2009

- 75%, if you purchased the stock between February 18, 2009, and September 27, 2010

2. Immediately after issuance, the corporation must have had less than $50 million of aggregate gross assets.

3. The stock must be in a qualified industry — the code specifically excludes certain industries including some service businesses, financial companies, energy production, farming, and hospitality.

4. At least 80% of the value of the corporation’s assets must be used in the conduct of an active business, not an inactive business or an investment holding company. This is known as the active business requirement.

5. The stock must have been held for at least five years.

If you meet these requirements and hold qualifying shares under Section 1202, here are the potential benefits you could qualify for:

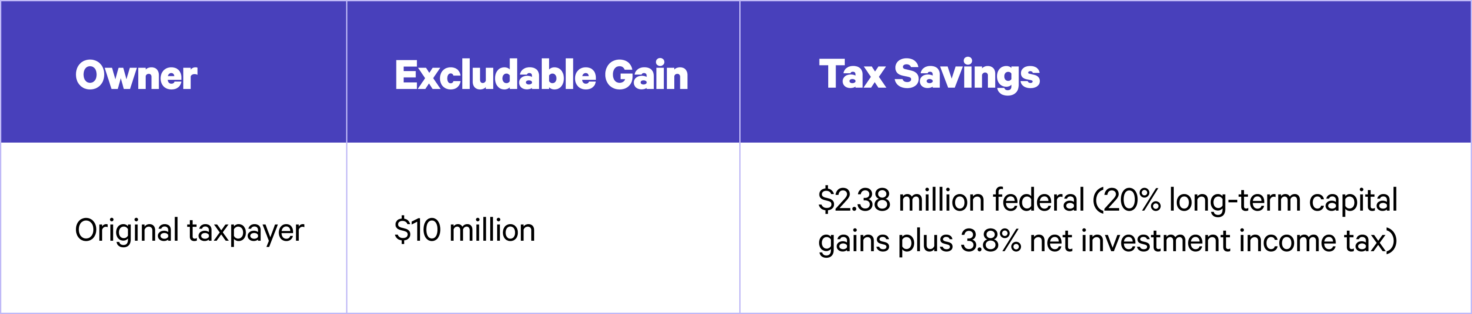

1. Exclude $10 million of capital gains

To stick with the baseball theme, this step is like hitting a single.

The most common benefit associated with QSBS is the ability to exclude up to $10 million of capital gains or 10 times your cost basis (whichever is higher) from your federal taxes.

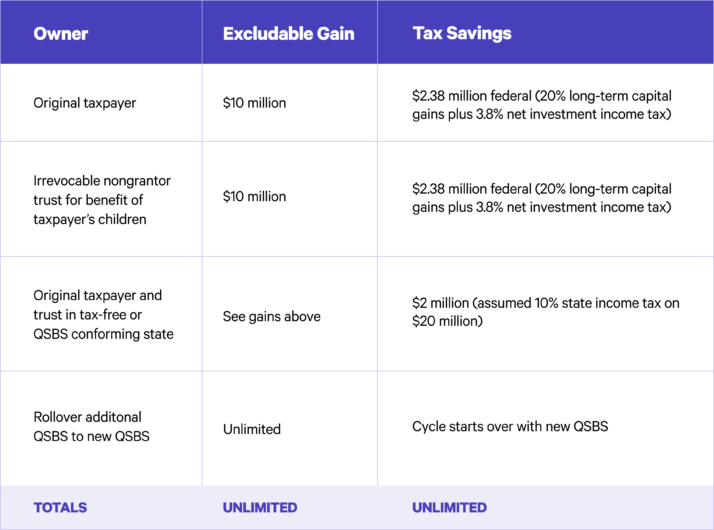

Sample tax savings breakdown:

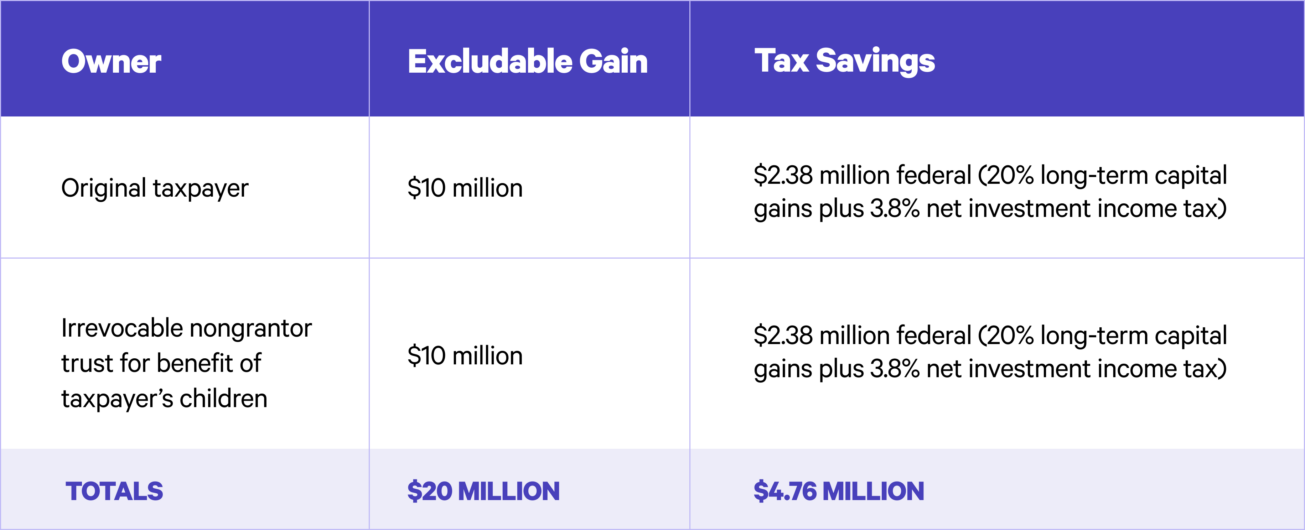

2. Gift qualifying stock for a boost upon sale of the stock

This is the equivalent of reaching second base.

Section 1202 says that each person is entitled to their own gain exclusion for stock that they own. This opens the door for a taxpayer holding qualifying stock to gift that stock to another taxpayer so they can receive all the benefits of QSBS when they sell the stock. This is possible because the gifted shares generally carry with them the QSBS attributes as well as the same holding period and carryover cost basis.

For example, this may apply to a gift made to an individual outright (like a family member) or made to an irrevocable non-grantor trust for the benefit of a child or relatives.

Sample tax savings breakdown:

The challenge

You must follow the rules for reporting a completed gift, valuing the shares of stock at the time of the gift and likely using up some of your lifetime gift and estate tax exemption.

Currently, the lifetime gift and estate tax exemption is $11.7 million. So in the above example, if you gift the shares to the trust when they’re valued at $10 million, you use up $10 million of your lifetime exemption.

This isn’t necessarily a bad thing because you’ll want to use your exemption on something eventually. And you may want to use it sooner rather than later if you believe the current Congress and administration may reduce the allowable exemption. To use up less of your lifetime exemption, you can make the gift much earlier in your holding period when the share value is lower.

This is a simplified example and these rules can become complex. It’s also important to note that while Section 1202 appears to allow for this technique, the IRS has yet to comment or provide any formal guidance. You should work with your tax advisor to make sure you’re executing this strategy correctly.

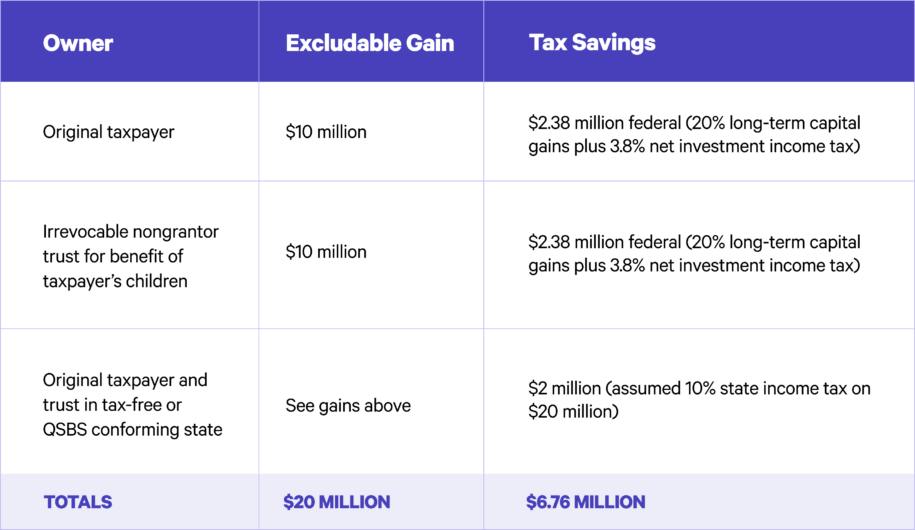

3. State tax-free treatment

If you want to hit a triple with QSBS, you might consider going for tax-free treatment at the state level.

There are several ways to do this, such as establishing your residency in a state that has one of the following criteria:

- No income tax

- No capital gains tax

- Conforms to the federal treatment for QSBS

Most states allow you to get tax-free treatment of QSBS, with a few exceptions—most notably California, Pennsylvania, Alabama, and Mississippi. Note that Massachusetts, New Jersey, and Hawaii only partially conform to federal QSBS rules.

Sample tax savings breakdown:

The challenge

You need to be a resident of the right state at the time of sale.

In other words, if you don’t already live in a tax-free state or QSBS conforming state and aren’t willing to move, this strategy isn’t available to you. If you’re willing to move, you can potentially save a lot on your taxes if you properly sever ties with your existing state and establish residency in your new state. There’s another option, too: You might be able to establish a trust in another state—and still have the trust qualify for QSBS benefits—without having to move your residency to that other state.

4. Additional tax savings with rollover method

With all this talk of base hits, what does a QSBS home run or maybe even a grand slam look like? One method is to use the provisions of IRC Section 1045 to do a QSBS rollover. Let’s say that you have a large amount of QSBS and have already:

- Realized the maximum $10 million tax-free gain personally

- Funded a trust using your lifetime gift exemption

- Moved from a high-tax state, such as California, to a tax-free state so that all this wasn’t only federal tax-free, but also state tax-free

In this scenario, you could consider a rollover if you still have QSBS remaining. Section 1045 allows you to roll over your gain from the sale of QSBS to a replacement QSBS investment within 60 days of selling your stock as long as you held the original QSBS for at least six months and met the other requirements of Section 1202.

Once you’ve purchased the replacement QSBS investment, so long as you continue to meet the requirements of Section 1202, you can then sell the QSBS and potentially qualify for a new set of benefits— starting the cycle over again with a new $10 million.

Sample tax savings breakdown:

The challenge

So, what’s the catch with attempting to hit a home run or grand slam? With the replacement QSBS investment, just like the original QSBS investment, you want to be sure you meet the Section 1202 requirements. This includes the active business requirement, especially if your replacement QSBS is purchased in a start-up that you control.

A powerful tax benefit

QSBS might seem complicated (and it is), but with a little planning, it can be an extremely effective way to lower your tax bill. If you’ve taken up angel investing and have the stock in your portfolio, playing QSBS baseball can be very rewarding.

Disclosure

The information contained in this communication is provided for general informational purposes only, and should not be construed as investment or tax advice. Nothing in this communication should be construed as a solicitation, offer, or recommendation, to buy or sell any security. Any links provided to other server sites are offered as a matter of convenience and are not intended to imply that Wealthfront Advisers or its affiliates endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Wealthfront Advisers and its affiliates do not provide legal or tax advice and do not assume any liability for the tax consequences of any client transaction. Clients should consult with their personal tax advisors regarding the tax consequences of investing with Wealthfront Advisers and engaging in these tax strategies, based on their particular circumstances. Clients and their personal tax advisors are responsible for how the transactions conducted in an account are reported to the IRS or any other taxing authority on the investor’s personal tax returns. Wealthfront Advisers assumes no responsibility for the tax consequences to any investor of any transaction.

Investment management and advisory services–which are not FDIC insured–are provided by Wealthfront Advisers LLC (“Wealthfront Advisers”), an SEC-registered investment adviser, and financial planning tools are provided by Wealthfront Software LLC (“Wealthfront”). Brokerage products and services are offered by Wealthfront Brokerage LLC (formerly known as Wealthfront Brokerage Corporation), member FINRA / SIPC. All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Please see our Full Disclosure for important details.

Wealthfront Advisers, Wealthfront Brokerage and Wealthfront are wholly owned subsidiaries of Wealthfront Corporation.

© 2021 Wealthfront Corporation. All rights reserved.

About the author(s)

Toby Johnston has provided tax and financial planning solutions since 2001. He specializes in stock option planning, qualified small business stock, and estate planning for executives, founders, and entrepreneurs. He can be reached at (408) 558-7570 or toby.johnston@mossadams.com. Assurance, tax, and consulting offered through Moss Adams LLP. Investment advisory services offered through Moss Adams Wealth Advisors LLC. View all posts by Toby Johnston, CPA, CFP