When markets are volatile (as they are right now), investors sometimes get uncomfortable. When your portfolio temporarily loses value, it can be very tempting to try and minimize your losses by stopping your regular investment account deposits. Unfortunately, when it comes to investing in a volatile market, what feels right is often wrong. In this post, we’ll show you why it’s important (and even beneficial) to keep investing despite market volatility.

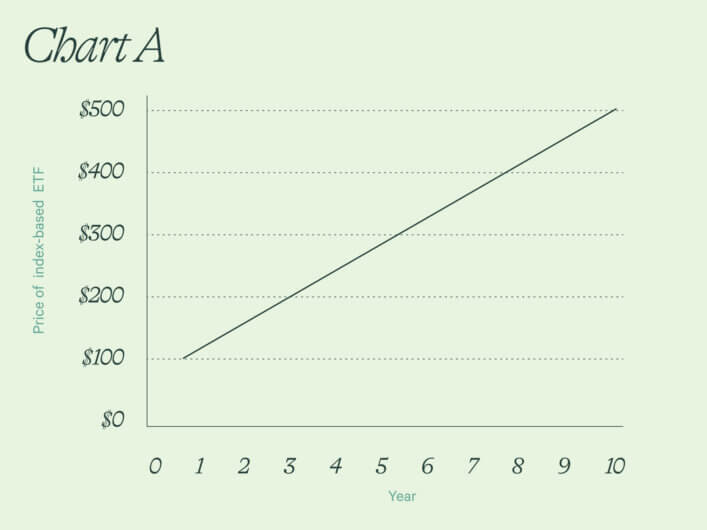

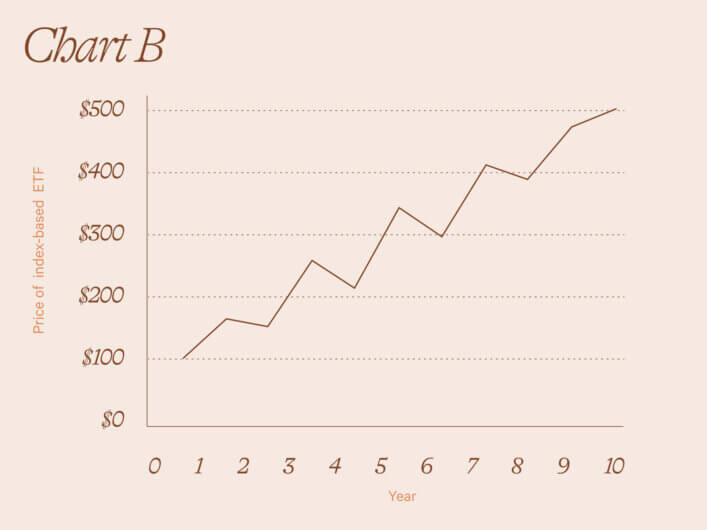

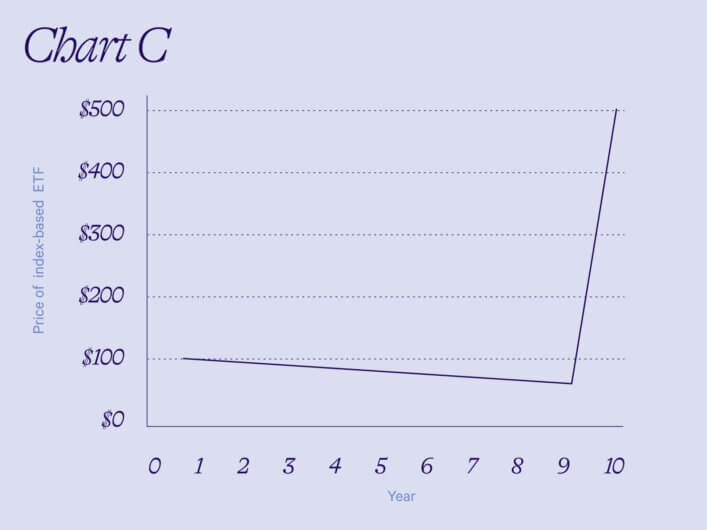

In an investing seminar I gave years ago, I showed members of the audience three graphs depicting different market behavior. I asked them which type of market they would prefer to invest in periodically each year if they didn’t intend to withdraw their money until 10 years from now. Here are the graphs illustrating an example of how an index-based ETF could fare in three potential market scenarios:

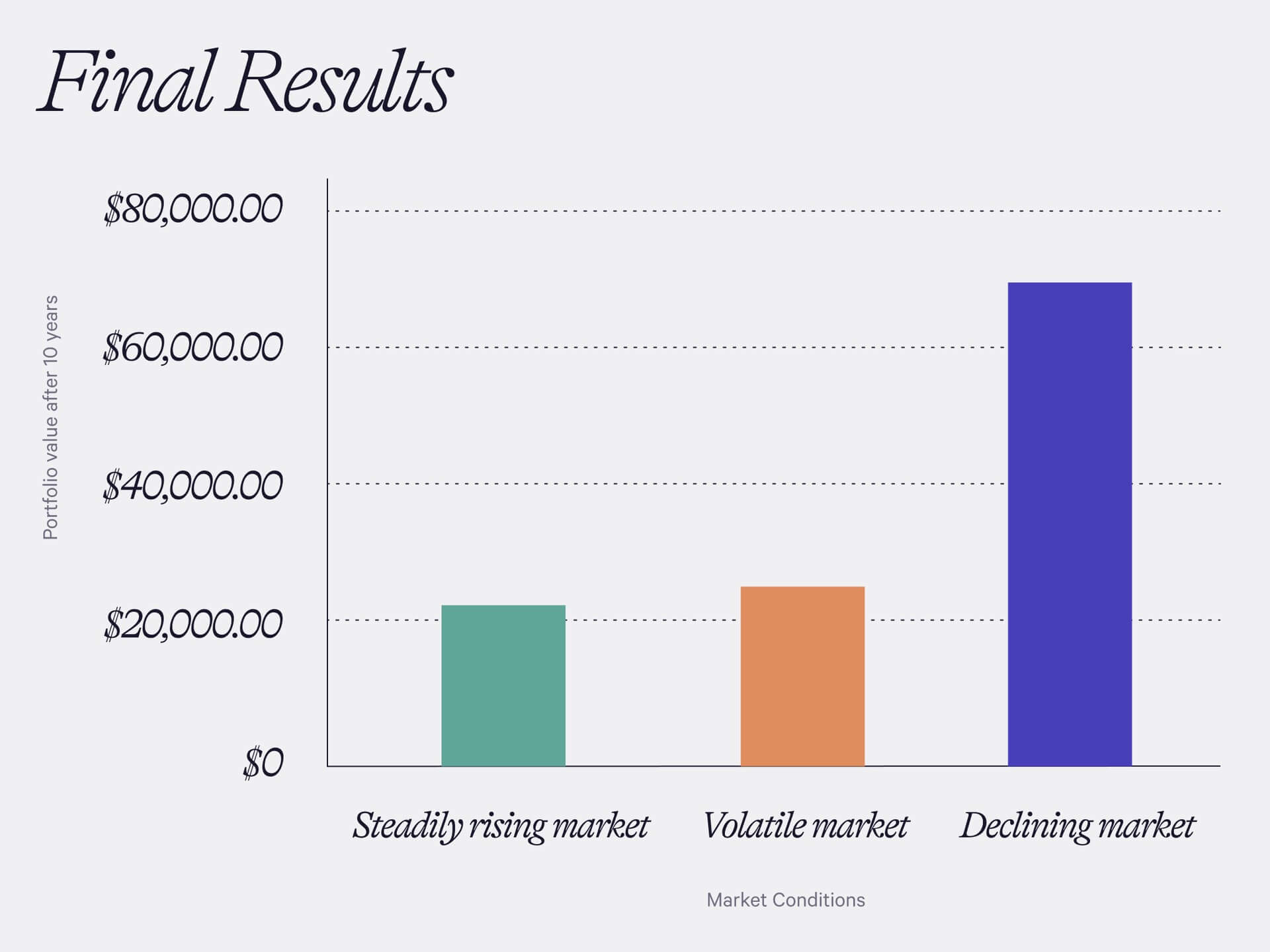

You probably won’t be surprised to learn that Chart A was the most popular choice, while Chart C got the fewest votes. However, you might be surprised to discover that Chart C actually represents the best market environment to invest in, while Chart A is the worst of the three.

Investing in different market conditions

Let’s dig into the numbers associated with each scenario.

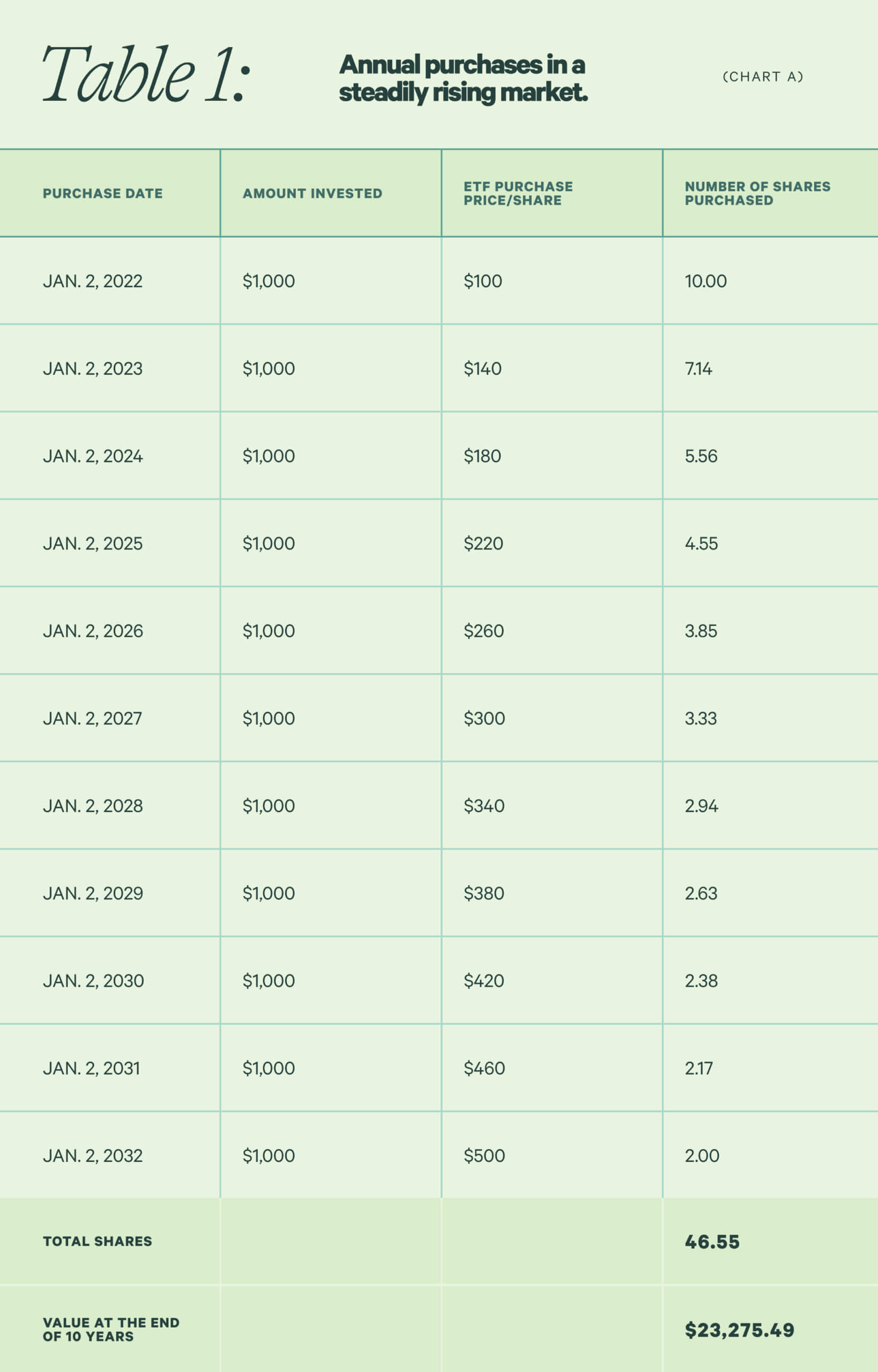

Investing in a steadily rising market

Table 1 shows an example of the potential price and number of shares of an index-based ETF that an investor might buy in a steadily rising stock market (Chart A) if they were to invest $1,000 on January 2 each year for the next 10 years:

As you can see, our investor will own 46.55 shares of the ETF, which will be worth $23,275.49 when they’re ready to liquidate their portfolio after 10 years.

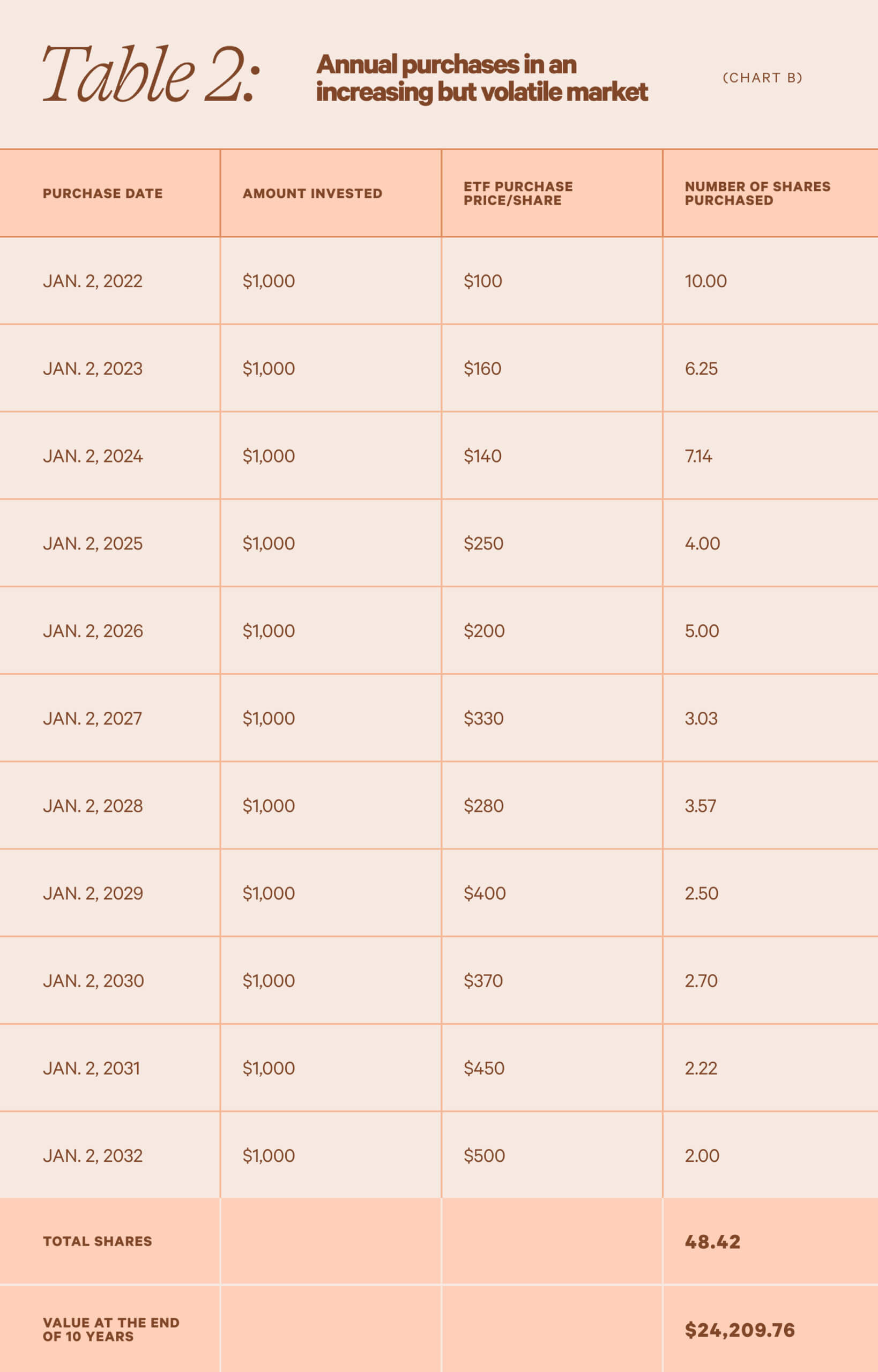

Investing in an increasing but volatile market

Now imagine our investor faces a rising but volatile market over the next 10 years. Table 2 displays the potential purchase price per share and the number of shares purchased for the same ETF in those market conditions:

On the 10th anniversary of their original investment, the investor will own 48.42 shares of the ETF, which will be worth $24,209.76 when they’re ready to liquidate their portfolio. Interestingly, investing at a constant clip in a rising but volatile market leads to greater value than investing at a constant clip in a steadily rising market. That’s because the investor gets to buy investments at a relative discount due to interim volatility.

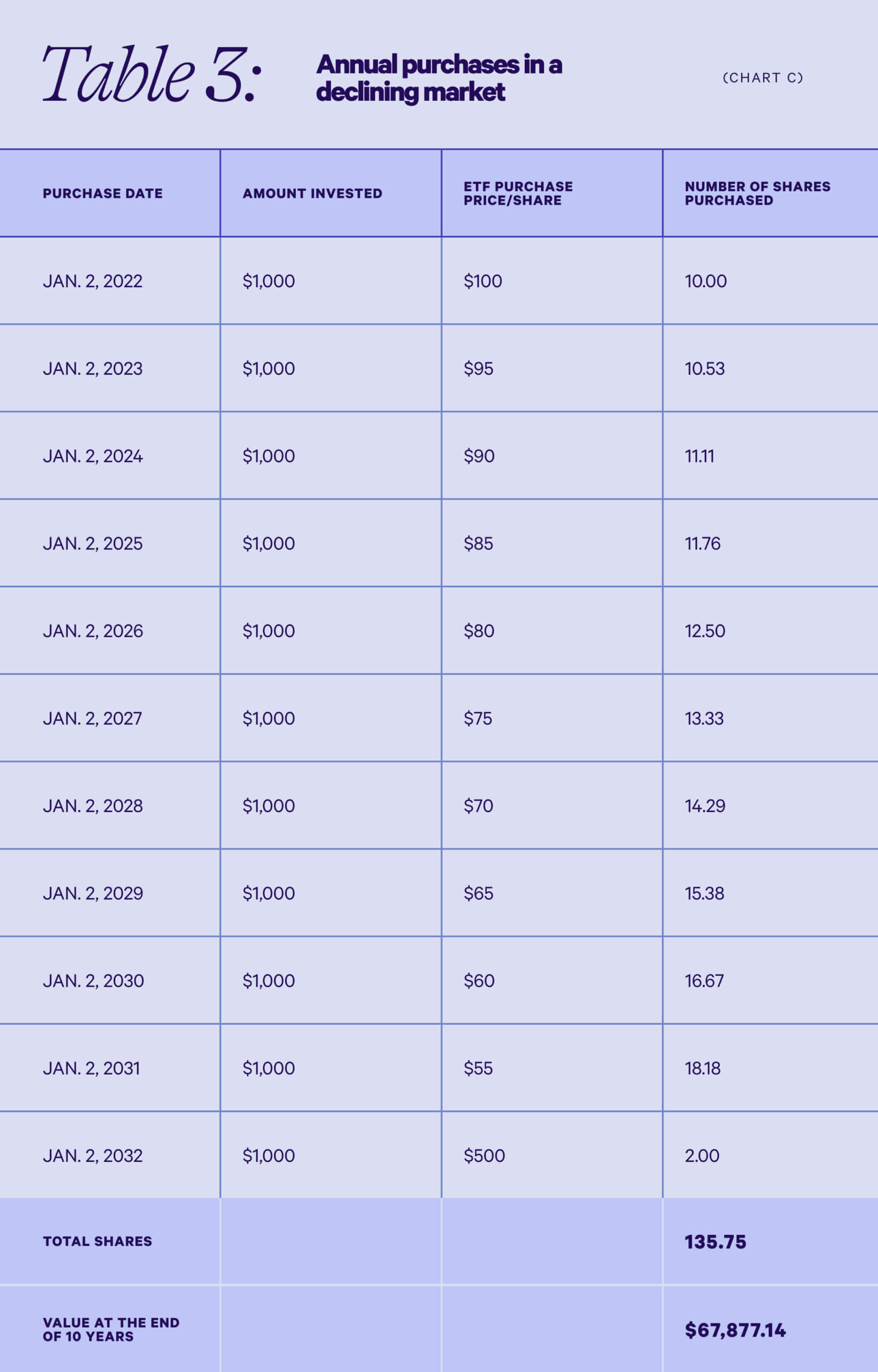

Investing in a declining market

Table 3 shows an example of the potential price and number of shares of an index-based ETF an investor might buy in a steadily declining stock market if they were to invest $1,000 on January 2 each year for the next 10 years:

Shockingly, this third scenario leads to the greatest value upon liquidation by far. That’s because in effect you’re buying the ETF at a steep discount. It doesn’t matter that the ETF declined during your investment period. All that matters is what it’s worth when you’re ready to liquidate your account.

You can make money in a volatile market

The point of our example is that interim volatility doesn’t matter; a volatile market can actually work to investors’ advantage because it gives them opportunities to buy at a relative discount. That doesn’t mean you should wait for a volatile market to invest, because it’s almost impossible to time the market. The lesson is you should ignore the behavior of the market if you intend to invest steadily and don’t plan on touching the vast majority of your account value for a number of years.

Markets generally rise over time. So if your investment horizon is fairly long (at least 3-5 years), then what happens in between doesn’t matter very much as long as your portfolio is ultimately worth more than what you paid for it.

Don’t be driven by fear of loss

Loss is uncomfortable, even if it’s temporary. But it’s important to remember that volatility is a normal part of investing, and you don’t actually lose any money unless you sell your investments for less than what you paid for them. History shows that markets tend to rise in the long run, which means if you stick to your strategy and keep investing, you’re likely to come out ahead.

We hope this post, which was inspired by an example in Elements of Investing by Wealthfront CIO Burt Malkiel and our investment advisory board member Charley Ellis, shows how little effect current market conditions can have on the eventual outcome of your investments. All you need to do is make a plan to invest regularly and stick to it no matter what the market does from day to day.

Disclosure

The information contained in this communication is provided for general informational purposes only, and should not be construed as investment or tax advice. Nothing in this communication should be construed as a solicitation, offer, or recommendation, to buy or sell any security. Any links provided to other server sites are offered as a matter of convenience and are not intended to imply that Wealthfront Advisers or its affiliates endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Investment management and advisory services–which are not FDIC insured–are provided by Wealthfront Advisers LLC (“Wealthfront Advisers”), an SEC-registered investment adviser, and financial planning tools are provided by Wealthfront Software LLC (“Wealthfront”). Brokerage products and services are offered by Wealthfront Brokerage LLC, member FINRA / SIPC. All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Please see our Full Disclosure for important details.

Wealthfront Advisers, Wealthfront Brokerage and Wealthfront are wholly owned subsidiaries of Wealthfront Corporation.

© 2022 Wealthfront Corporation. All rights reserved.

About the author(s)

Andy Rachleff is Wealthfront's co-founder and Executive Chairman. He serves as a member of the board of trustees and chairman of the endowment investment committee for University of Pennsylvania and as a member of the faculty at Stanford Graduate School of Business, where he teaches courses on technology entrepreneurship. Prior to Wealthfront, Andy co-founded and was general partner of Benchmark Capital, where he was responsible for investing in a number of successful companies including Equinix, Juniper Networks, and Opsware. He also spent ten years as a general partner with Merrill, Pickard, Anderson & Eyre (MPAE). Andy earned his BS from University of Pennsylvania and his MBA from Stanford Graduate School of Business. View all posts by Andy Rachleff