Editor’s note: Interested in learning more about equity compensation, the best time to exercise options, and the right company stock selling strategies? Read our Guide to Equity & IPOs

A flood tide of shares is hitting the market in May and June, as a number of the high-profile tech IPOs from the fall emerge from lockup periods, including Jive Software (JIVE), Zynga (ZNGA) and Angie’s List (ANGI).

If you’re one of the employees of the 28 companies whose lockups are expiring in May or June, you’re wondering how to diversify your portfolio and when to sell.

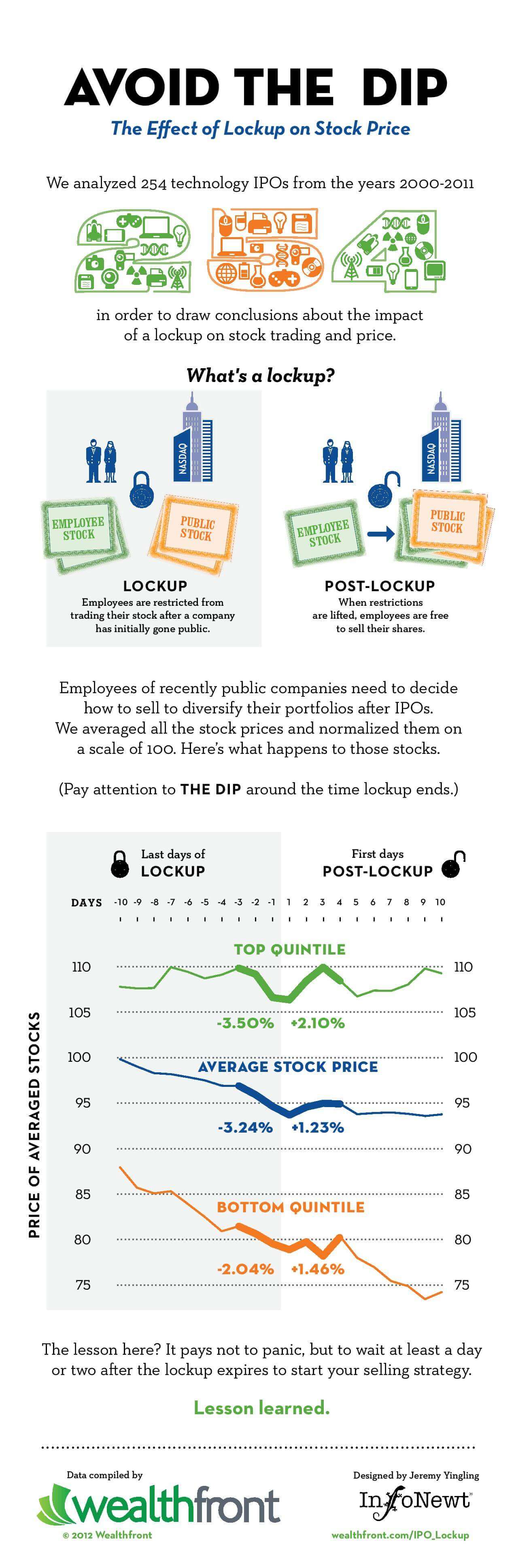

Here’s our research on the question of what to do in the days immediately following the lockup expiration, presented visually to help you see the dip that typically follows the end of the lockup.*

You’ll also notice that it shows the big difference between top-performing and bottom-performing stocks, as well as the average. All three groups of companies experienced the dip, but only some of them later rebounded.

How to tell if your company will be one of those which rebounds? Here’s a blog post that covers that question more in depth: Real data-based guidance on selling stock post-IPO.

Some companies have more than one lockup expiration, which may help mitigate the lockup effect. For instance, in Zynga’s case, the bulk of its shares offered in the IPO – 325 million shares – will emerge from the lockup on May 30. But in early April, Zynga had a secondary offering of 200 million shares to build the float in order to attract new institutional investors. (We expect to have a blog post that discusses secondary offerings soon). The two lockups on that offering, of shares held by directors, officers and some select shareholders, will expire July 6 and Aug. 16.

*The analysis contained in this infographic is based on publicly available data reviewed by Wealthfront for the years 2000 to 2011; past performance is no guarantee of future results.

Disclosure

Nothing in this blog should be construed as tax advice, a solicitation or offer, or recommendation, to buy or sell any security. Financial advisory services are only provided to investors who become Wealthfront Inc. clients pursuant to a written agreement, which investors are urged to read carefully, that is available at www.wealthfront.com. All securities involve risk and may result in some loss. For more information please visit www.wealthfront.com or see our Full Disclosure. While the data Wealthfront uses from third parties is believed to be reliable, Wealthfront does not guarantee the accuracy of the information.

This article is not intended as tax advice, and Wealthfront does not represent in any manner that the outcomes described herein will result in any particular tax consequence. Prospective investors should confer with their personal tax advisors regarding the tax consequences based on their particular circumstances. Wealthfront assumes no responsibility for the tax consequences to any investor of any transaction. Investors and their personal tax advisors are responsible for how the transactions in an account are reported to the IRS or any other taxing authority.

About the author(s)

Journalist Elizabeth MacBride is Wealthfront's editor. Her work has appeared in Crain's New York, Advertising Age, the Washington Post and the Christian Science Monitor, among other publications. View all posts by Elizabeth MacBride