Depending on the company you work for, your compensation may include some form of equity — likely stock options or restricted stock units (RSUs). In this post, we’ll explain what they are, how they differ, and why you’re likely to be granted fewer RSUs than stock options (all other things being equal).

What are stock options?

Employer-granted stock options give you the option to buy company stock at a certain price at a certain time. Buying the stock is called exercising your options. The price you’ll pay to do that is called the exercise price or strike price — this price is set when you are granted your options. Employer-granted stock options can be incentive stock options (ISOs) or non-qualified stock options (NSOs), and their tax treatment varies (more on that below). Stock options are often subject to vesting, which means you may need to work at the company for a certain amount of time before you can exercise your options.

What are RSUs?

RSUs are claims for shares of company stock given to employees as a form of compensation. Unlike stock options, you don’t have to pay to exercise RSUs — once they vest, they’re yours. Historically, RSUs were far more common for employees of public companies than those who work at private companies. But over the last 20 years, RSUs have become much more common at private companies that have closed rounds of financing at large valuations (over $1 billion) when that valuation isn’t likely to be achieved or justified for a few years. Like stock options, RSUs are usually subject to vesting.

Stock options vs. RSUs

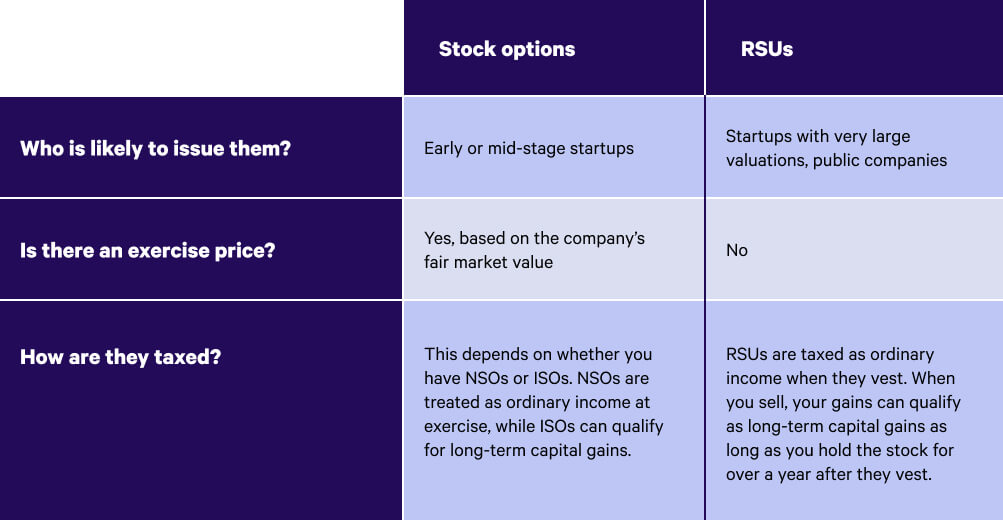

Here’s a breakdown of the key differences between stock options and RSUs:

RSUs and stock options have very different tax treatment

Equity compensation can make your tax situation more complicated, and it’s important to understand what you could owe. Let’s take a closer look at the tax treatment of stock options and RSUs.

How RSUs are taxed

RSUs are taxed as soon as they vest and are liquid. In many cases, your employer will withhold some of your RSUs as payment for taxes owed at the time of vesting. You might also get the option to pay those taxes with cash in order to retain all of your vested RSUs. Either way, your RSUs will be taxed at ordinary income rates which could be as high as 37% at the federal level plus Social Security and Medicare taxes, depending on your income. You may owe additional taxes at the state level, depending on where you live.

How stock options are taxed

In contrast, stock options are taxed when you exercise them and/or when you sell them. This means you might want to exercise your options in a year when you anticipate your tax rate will be relatively low (or you have a lot of harvested losses to use from an investment manager like Wealthfront). If you early exercise your options before they’ve increased in value and file an 83(b) election within 30 days, then you won’t owe any taxes until you sell.

The rest depends on whether you have NSOs (which are more common) or ISOs. With NSOs, you will be taxed at ordinary income rates on the difference between the exercise price and the current fair market value when you exercise. If you then hold the shares for over a year, any gains or losses going forward will be taxed at the lower, long-term capital gains rate (which ranges from 0% to 20%). If you have ISOs, exercising your options is not a taxable event for regular tax purposes. Any increase in value over the exercise price will be taxed at the long-term capital gains rate when you sell as long as you meet both of the following conditions:

- You hold the shares for at least two years after they were granted to you.

- You hold the shares for at least one year after exercising them

You should also be aware of the alternative minimum tax (AMT) if you have ISOs. AMT is a separate tax system designed to make sure high earners pay at least a minimum (hence the name) amount of taxes. If you exercise your ISOs and don’t sell them that year, the difference between the exercise price and the fair market value at the time of exercise is subject to AMT even if you didn’t sell any shares. AMT can make filing your taxes far more complicated, which is why we think it’s smart to consider working with a tax professional if you think you might be subject to AMT. Whether or not you pay AMT is largely dependent on your income — in 2021, if you’re a single filer making less than $73,600 or a married couple filing jointly making less than $114,600, you don’t need to worry about it. If you earn more than that, however, you’ll need to calculate your taxes under both systems (AMT and the regular system) and pay whichever amount is bigger. The good news is your AMT payments are credited against the taxes owed upon sale of your options.

Why you’ll get fewer RSUs than stock options for the same job

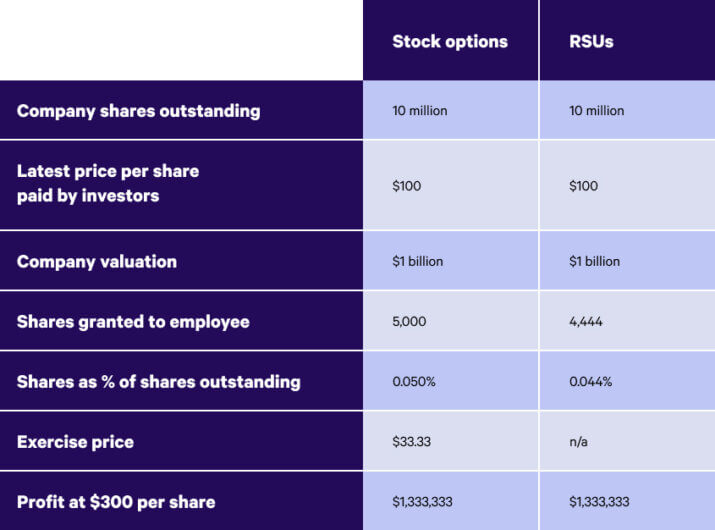

You should expect to receive fewer RSUs than stock options for the same job because RSUs don’t have an exercise price. Let’s look at a hypothetical private company example to illustrate this. Imagine a company with 10 million shares outstanding that just completed a financing at $100 per share, which translates to a $1 billion valuation. If you knew that the company would ultimately be worth $300 per share, then you’d need to issue 11% fewer RSUs than stock options to deliver the same net value to the employee.

Here’s a chart to help you visualize this example:

You should also keep in mind that RSUs have value independent of how the company performs, whereas stock options can become worth less than the exercise price if the company struggles. Put more simply: RSUs are less risky than stock options.

Key takeaways: RSUs and stock options

If you receive equity as part of your compensation, here’s what you need to remember about RSUs and stock options:

- Both RSUs and stock options give you the opportunity to own a piece of the company you work for.

- RSUs don’t have an exercise price, but stock options do — that’s why you’ll receive fewer RSUs than stock options for the same job.

- RSUs give you less flexibility when it comes to taxes (both the timing and the rate) than stock options do.

Hopefully this information helps you confidently navigate the equity portion of your compensation. For more guidance on how to handle RSUs, check out this blog post for our advice on managing vested RSUs — generally, we think it’s smart to sell some portion of your RSUs and invest in a more diversified way (Wealthfront’s Automated Investing Accounts make this easy). For a deep dive on all things related to equity, we encourage you to read Wealthfront’s Guide to Equity & IPOs.

Disclosure

The information contained in this communication is provided for general informational purposes only, and should not be construed as investment or tax advice. Nothing in this communication should be construed as a solicitation, offer, or recommendation, to buy or sell any security. Any links provided to other server sites are offered as a matter of convenience and are not intended to imply that Wealthfront Advisers or its affiliates endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Wealthfront Advisers and its affiliates do not provide legal or tax advice and do not assume any liability for the tax consequences of any client transaction. Clients should consult with their personal tax advisors regarding the tax consequences of investing with Wealthfront Advisers and engaging in these tax strategies, based on their particular circumstances. Clients and their personal tax advisors are responsible for how the transactions conducted in an account are reported to the IRS or any other taxing authority on the investor’s personal tax returns. Wealthfront Advisers assumes no responsibility for the tax consequences to any investor of any transaction.

Investment management and advisory services–which are not FDIC insured–are provided by Wealthfront Advisers LLC (“Wealthfront Advisers”), an SEC-registered investment adviser, and financial planning tools are provided by Wealthfront Software LLC (“Wealthfront”). Brokerage products and services are offered by Wealthfront Brokerage LLC, member FINRA / SIPC. All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Please see our Full Disclosure for important details.

Wealthfront Advisers, Wealthfront Brokerage and Wealthfront are wholly owned subsidiaries of Wealthfront Corporation.

Copyright 2021 Wealthfront Corporation. All rights reserved.

About the author(s)

Andy Rachleff is Wealthfront's co-founder and Executive Chairman. He serves as a member of the board of trustees and chairman of the endowment investment committee for University of Pennsylvania and as a member of the faculty at Stanford Graduate School of Business, where he teaches courses on technology entrepreneurship. Prior to Wealthfront, Andy co-founded and was general partner of Benchmark Capital, where he was responsible for investing in a number of successful companies including Equinix, Juniper Networks, and Opsware. He also spent ten years as a general partner with Merrill, Pickard, Anderson & Eyre (MPAE). Andy earned his BS from University of Pennsylvania and his MBA from Stanford Graduate School of Business. View all posts by Andy Rachleff