Diversification is the practice of buying a variety of different investments with the goal of balancing risk and reward in your portfolio. A well-diversified portfolio can help you maximize your expected returns without taking on unnecessary or unwanted risk. This is known as “improving your risk-adjusted returns.”

You can think of diversification as a way to avoid putting all your eggs in one basket. It’s very hard to outperform the market by picking specific investments (research shows that even professional investors struggle to do this consistently). However, if you have a diversified portfolio, some of your investments may win and others may lose in different market conditions—and owning a broad range of investments can smooth out your returns in the long run. Plus, in volatile market conditions, you can take comfort in the fact that a diversified portfolio is often better insulated from dramatic losses.

In this post, we’ll explain what diversification is and why it matters.

What makes a portfolio diversified?

Many investors think they have a well-diversified portfolio when, in reality, they don’t. In The Elements of Investing, Burton Malkiel (Wealthfront’s Chief Investment Officer) and Charley Ellis (noted investor, author, and member of our investment advisory board) outline the three dimensions of diversification you need to improve your chances of long-term investing success.

The three ways you can (and should) diversify your portfolio are:

- Across assets

- Across asset classes

- Across time

Let’s take a closer look at how to apply this to your portfolio.

How to diversify your portfolio

1. Diversify across assets

Diversifying across assets means investing in the stocks or bonds of many companies and issuers, not just a few. This is valuable because an individual stock, or even a handful of stocks, is likely to experience far more dramatic fluctuations in value than a large group of stocks will.

Doubling down on your company stock is a glaring example of not diversifying across assets. Even if you work for Apple, Google, or Facebook, owning too much of your own company stock has the potential to create serious financial problems. In their book, Burton and Charley describe an Enron employee who invested her entire retirement savings in Enron stock through the company’s 401(k) plan, only to see her savings decimated when Enron unraveled.

This is an extreme example, but the general point is that individual stock ownership represents diversifiable risk (in contrast to market or systemic risk). Diversifiable risk, by definition, is risk specific to an individual company or industry that can be reduced by spreading your portfolio across a broad set of investments. To be diversified across assets, don’t invest a lot of your portfolio in any single stock, and don’t allow your company stock to dominate your portfolio after it has become vested and liquid.

Instead of investing a large amount of money in a single stock, consider investing your money in a group of stocks or broadly diversified index funds. For example, if you wanted to get exposure to US equities, you could consider a low-cost ETF like VTI, which gives you exposure to over 4,000 U.S. stocks (including Apple, Google, and Facebook) for a low 0.03% annual expense ratio (which means you pay $3 annually for every $10,000 you invest).

2. Diversify across asset classes

Another important way to diversify is across asset classes and capital markets. You can improve your risk-adjusted returns by investing in less correlated assets, because it is virtually impossible to predict which asset class is going to outperform the others in any given year. That’s why Wealthfront’s expert-built Classic portfolios contain at least five asset classes, and sometimes more depending on your individual risk tolerance.

Anyone who tells you they can predict the performance of different asset classes with any reasonable consistency is either fooling themselves or trying to fool you. This is market timing, and you shouldn’t bother with it. Jack Bogle, the founder of the Vanguard Group, had a great saying about trying to time the market: “After nearly 50 years in this business, I do not know of anyone who has done it successfully and consistently. I don’t even know anybody who knows anybody who has done it successfully and consistently.”

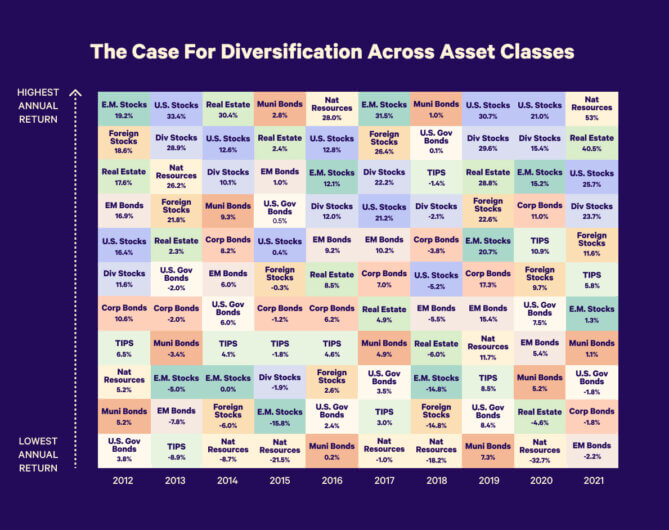

To illustrate this point, we put together the table below. It displays the ranking of asset class returns by year for the past 10 years. The key takeaway is that no asset class consistently wins or loses. In fact, there’s a different winner nearly every year.

You might be surprised to learn that US stocks have only been the top-performing asset class for 3 out of the last 10 years. From year to year, a given asset class can have very different performance. Look at natural resources, for example. It was the worst-performing asset class in 2020 (with returns of -32.7%) and the best-performing asset class just one year later in 2021 (with returns of 53%). This kind of variation is exactly why it’s beneficial to own investments from a broad range of asset classes—the more asset classes you invest in, the more likely you are to have high performers in your portfolio.

3. Diversify across time

The final dimension of diversification is time. It’s better to invest as early in your career as you can to give your returns more time to compound. There is nothing as magical in investing as generating returns on top of prior returns and repeating this over and over again. Albert Einstein reportedly said: “Compound interest is the eighth wonder of the world.” Of course, to take full advantage of compounding, you also need to stay invested through market ups and downs.

In an ideal world, you would invest a large amount of money as early as possible and leave it in the market for a very long time. Unfortunately, this isn’t consistent with how most people earn (i.e. salary, vested company stock, bonuses) and you may need to work through some decisions (like buying a home or paying off student loans) before investing a large sum anyway. Plus, investing all at once can make you sensitive to the timing of your investments—you might worry about picking the “wrong day.”

Because of this, too many investors suffer from decision paralysis: they are so afraid of picking the “wrong day” to invest, they end up not investing their savings at all. As a result, they miss out on valuable time in the market when their savings could have been compounding.

Dollar-cost averaging is a popular way to diversify across time and avoid this issue. Rather than picking the “right day” to invest, dollar-cost averaging is a process where investors break up a lump sum into several smaller amounts, and then invest a portion consistently on a set schedule. For example, an investor with a $20,000 bonus might invest $4,000 per month for five months instead of putting it all in the market on the same day.

Wealthfront’s automation features make it easy to diversify across time: you can set up recurring deposits and our software will automatically handle the trades for you. You can invest a specific amount every pay cycle, for example, or use recurring deposits to dollar-cost average a large sum of money into the market. We’ll also rebalance your investments automatically so your portfolio stays well diversified for your risk tolerance and goals over time.

Diversify your investments to build long-term wealth

If you diversify across all three dimensions recommended in this post, you’re in a better position to increase your risk-adjusted returns over the long run—and investing in a properly diversified portfolio doesn’t have to be a lot of work. You can invest in Wealthfront’s expert-built Classic, Socially Responsible, and Direct Indexing portfolios with just a few clicks.

Having a well-diversified portfolio also lets you benefit from rebalancing and tax-loss harvesting. Wealthfront offers both of these services to clients at no additional cost. In 2021, clients who started using Tax-Loss Harvesting in a Classic or Socially Responsible portfolio received estimated tax savings worth between 4-9x Wealthfront’s annual advisory fee.

Disclosure

The effectiveness of the Tax-Loss Harvesting strategy to reduce the tax liability of the client will depend on the client’s entire tax and investment profile, including purchases and dispositions in a client’s (or client’s spouse’s) accounts outside of Wealthfront Advisers and type of investments (e.g., taxable or nontaxable) or holding period (e.g., short- term or long-term).Tax loss harvesting may generate a higher number of trades due to attempts to capture losses. There is a chance that trading attributed to tax loss harvesting may create capital gains and wash sales and could be subject to higher transaction costs and market impacts. In addition, tax loss harvesting strategies may produce losses, which may not be offset by sufficient gains in the account and may be limited to a $3,000 deduction against income. The utilization of losses harvested through the strategy will depend upon the recognition of capital gains in the same or a future tax period, and in addition may be subject to limitations under applicable tax laws, e.g., if there are insufficient realized gains in the tax period, the use of harvested losses may be limited to a $3,000 deduction against income and distributions. Losses harvested through the strategy that are not utilized in the tax period when recognized (e.g., because of insufficient capital gains and/or significant capital loss carryforwards), generally may be carried forward to offset future capital gains, if any.

The information contained in this communication is provided for general informational purposes only, and should not be construed as investment or tax advice. Nothing in this communication should be construed as a solicitation, offer, or recommendation, to buy or sell any security. Any links provided to other server sites are offered as a matter of convenience and are not intended to imply that Wealthfront Advisers or its affiliates endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Investment management and advisory services–which are not FDIC insured–are provided by Wealthfront Advisers LLC (“Wealthfront Advisers”), an SEC-registered investment adviser, and financial planning tools are provided by Wealthfront Software LLC (“Wealthfront”). Brokerage products and services are offered by Wealthfront Brokerage LLC, member FINRA / SIPC. All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Please see our Full Disclosure for important details.

Wealthfront Advisers, Wealthfront Brokerage and Wealthfront are wholly owned subsidiaries of Wealthfront Corporation.

© 2022 Wealthfront Corporation. All rights reserved.

About the author(s)

Fang Rui is a Chartered Financial Analyst (CFA) and an investment researcher at Wealthfront. Prior to Wealthfront, Fang spent nearly a decade at BlackRock where she worked in ETF and index research as well as risk management. She earned a Master of Science in Industrial Engineering and Operations Research from University of California, Berkeley and earned a Bachelor of Science in Engineering with a major in Operations Research and Financial Engineering from Princeton University. View all posts by Fang Rui, CFA