Vanguard versus Wealthfront - how do the two compare? In this post, we compare the two services and explain the relative advantages of Wealthfront.

I am often asked by people unfamiliar with our service, “Why should I use Wealthfront to buy a portfolio of Vanguard index funds, when I could buy the same funds directly from Vanguard without paying any advisory fee?”

It’s a perfectly reasonable question, and it has a very simple answer. Wealthfront can save you significantly more money in taxes than the 0.25% a year you’ll pay us in advisory fees — in fact up to 10 times as much1. There’s also the comfort of knowing that you can take a “set it and forget it” attitude towards your investment, confident that professionals will be looking after the routine housekeeping tasks that are crucial for any investing strategy. Even Vanguard’s management team has told me we offer a superior service for taxable accounts.

Some investors prefer to manage their portfolios themselves, just like some people like to build their own furniture. If this describes you, then we’re not here to convert you. In fact, we give you our recommended portfolio allocation for free. You’re welcome to tweak it and implement it yourself, at Vanguard or anywhere else.

Many of our customers, though, are attracted by simple convenience, not to mention the significant annual tax saving Wealthfront is capable of generating.

How does Wealthfront provide this extra value? Through three services we pioneered: dividend-based rebalancing, Daily Tax-Loss Harvesting and Stock-level Tax-Loss Harvesting.

Rebalancing

Rebalancing is the process of maintaining the risk profile of your portfolio by selling asset classes that have performed relatively well and buying ones that performed relatively poorly. Every portfolio should be rebalanced on a periodic basis to make sure it hasn’t, without you realizing it, taken on more (or less) risk than you’re comfortable with.

Because it appears to be quite simple, many people believe they can do rebalancing themselves. In fact, since the process turns out to be far more complicated than many investors believe, investors too often have much less success than they expected to.

Not only does Wealthfront rebalance your portfolio, but we do so in a much more tax-efficient way than simply buying and selling securities. Specifically, we use the dividends generated by each of your index based ETFs to buy more of your under-allocated asset classes. That cuts down on the sale of over-allocated assets. Fewer sales means fewer gains, which means lower taxes.

Tax-Loss Harvesting

Tax-loss harvesting is a way of reducing your taxes by taking advantage of investments that have declined in value. These holdings are sold, and replaced with highly-correlated, but not identical, investments, allowing you to maintain the risk and return characteristics of your portfolio while generating a loss that can be applied to lower your taxes.

It is possible to do tax-loss harvesting yourself. But the enormous complexity of keeping track of all your different tax lots limits you, for all practical purposes, to doing it once a year at year-end. In contrast, Wealthfront’s software looks for losses on a daily basis. Our research shows that daily harvesting can save significantly more than when done annually.

Many people assume that tax-loss harvesting is a generic function, like the compounding of interest, and that all investment companies do it as well as any other. But Wealthfront research has demonstrated that not all tax-loss harvesting from automated investment services are alike.

Stock-level Tax-Loss Harvesting

Wealthfront’s Stock-level Tax-Loss Harvesting service allows you to own all the stocks in a major index (like the S&P 500), while also harvesting losses they might generate. That means you can take advantage of the times individual stocks trade down, even when the overall index rises. Index funds and ETFs, like the ones you can buy from Vanguard, cannot provide this service, because investments that are structured as funds are prohibited by the Internal Revenue Code applicable to funds registered under Investment Company Act of 1940 from distributing tax losses to their shareholders.

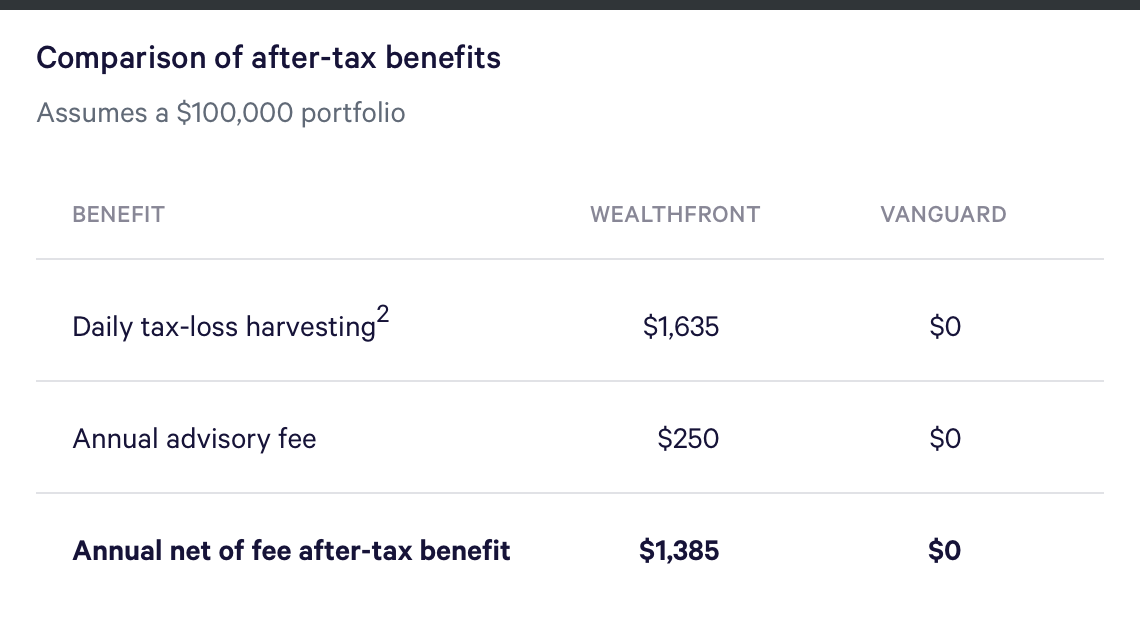

The table below compares just the after-tax benefits of daily tax-loss harvesting for a $100,000 account at Wealthfront, with the same portfolio invested with Vanguard:

As you can see, for a $250 annual advisory fee (0.25% of $100,000), Wealthfront could deliver an additional $1,385 of net-of-fee, after-tax value per year from just tax-loss harvesting. Your actual benefit will depend on your tax rate, risk level and ability to use the benefit from all your harvested losses. Even if the losses generated from our tax-loss harvesting could only be applied to your annual $3,000 ordinary income limit, as is the case with some taxpayers, your annual net benefit using an assumed tax rate of 42.7% would be $1,0313. Keep in mind the benefits calculated do not include the additional benefits that could be realized from dividend based rebalancing and Stock-level Tax-Loss Harvesting. Clearly, your small Wealthfront annual advisory fee is money well-spent, for both convenience as well as for direct, dollars-in-your-pocket savings.

What about retirement accounts?

By now, I hope you’re persuaded that Wealthfront’s service is far superior to managing a taxable portfolio on your own. But how about your IRA? Well, if your only investment account is an IRA, and you don’t mind rebalancing yourself, then Vanguard is likely a better option than Wealthfront. But if you have taxable and IRA accounts, then once again you will come out ahead with Wealthfront.

Unless the vast majority of your money is held in your IRA accounts, the tax benefits we generate just on your taxable account(s) should still be far greater than our advisory fee on all your accounts, not to mention how much more convenient it is to have all your investment accounts in the same place. Please keep in mind that because of the Wash Sale Rule, which comes into play if you don’t allow our software to manage all your accounts with similar securities, it is not possible to guarantee all your harvested losses can be applied to your taxes. That’s why it‘s advisable to keep all your accounts (other than your company 401(k)) at Wealthfront.

We think the evidence of Wealthfront’s value is overwhelming, and we hope you give us a try. Because if you like Vanguard, you’ll love Wealthfront.

1. Based on our actual results for our five years offering tax-loss harvesting, we were able to harvest average annual losses of 2.90% to 5.19% of portfolio value, depending on risk level. Assuming total state and federal tax rates of 25% to 50% the average annual after tax benefit of tax-loss harvesting ranges from 0.73% to 2.6%. That represents a multiple of three to 10 times our annual advisory fee of 0.25%.

2. The average actual annual realized harvested loss over the past five years across all risk levels was 3.83%. Assuming a 42.7% combined federal plus state tax rate (equivalent to a joint income of $250-400K in California), the average annual after tax benefit would be 1.635% or $1,635 on a $100,000 portfolio. The average annual benefit will vary based on risk level of portfolio and tax rate.

3. 42.7% times $3,000 minus our annual fee of $250.

Disclosure

This blog was prepared to support the marketing of Wealthfront’s investment products, as well as to explain its tax-loss harvesting strategies. Nothing in this blog should be construed as tax advice, a solicitation or offer, or recommendation, to buy or sell any security. Financial advisory services are only provided to investors who become Wealthfront Inc. clients pursuant to a written agreement, which investors are urged to read carefully, that is available at www.wealthfront.com. All securities involve risk and may result in some loss. For more information, please visit www.wealthfront.com or see our Full Disclosure. While the data Wealthfront uses from third parties is believed to be reliable, Wealthfront does not guarantee the accuracy of the information.

This blog is not intended as tax advice, and Wealthfront does not represent in any manner that the tax consequences described herein will be obtained or that Wealthfront’s tax-loss harvesting strategies, or any of its products and/or services, will result in any particular tax consequence. The tax consequences of the tax-loss harvesting strategy and other strategies that Wealthfront may pursue are complex and uncertain and may be challenged by the Internal Revenue Service (IRS). This blog was not prepared to be used, and it cannot be used, by any investor to avoid penalties or interest. Investors should confer with their personal tax advisors regarding the tax consequences of investing with Wealthfront and engaging in a tax strategy, based on their particular circumstances. Investors and their personal tax advisors are responsible for how the transactions in an account are reported to the IRS or any other taxing authority.

Actual investors on Wealthfront may experience different results from the results shown. Wealthfront assumes no responsibility for the tax consequences to any investor of any transaction.

Wealthfront’s investment strategies, including portfolio rebalancing and tax-loss harvesting, can lead to high levels of trading. High levels of trading could result in (a) bid-ask spread expense; (b) trade executions that may occur at prices beyond the bid ask spread (if quantity demanded exceeds quantity available at the bid or ask); (c) trading that may adversely move prices, such that subsequent transactions occur at worse prices; (d) trading that may disqualify some dividends from qualified dividend treatment; (e) unfulfilled orders or portfolio drift, in the event that markets are disorderly or trading halts altogether; and (f) unforeseen trading errors.

When Wealthfront replaces investments with “similar” investments as part of the tax-loss harvesting strategy, it is a reference to investments that are expected, but are not guaranteed, to perform similarly and that might lower an investor’s tax bill while maintaining a similar expected risk and return on the investor’s portfolio. Wealthfront assumes no responsibility to any investor for the tax consequences of any transaction.

Tax loss harvesting may generate a higher number of trades due to attempts to capture losses. There is a chance that Wealthfront trading attributed to tax loss harvesting may create capital gains and wash sales and could be subject to higher transaction costs and market impacts. In addition, tax loss harvesting strategies may produce losses, which may not be offset by sufficient gains in the account and may be limited to a $3,000 deduction against income. The utilization of losses harvested through the strategy will depend upon the recognition of capital gains in the same or a future tax period, and in addition may be subject to limitations under applicable tax laws, e.g., if there are insufficient realized gains in the tax period, the use of harvested losses may be limited to a $3,000 deduction against income and distributions. Losses harvested through the strategy that are not utilized in the tax period when recognized (e.g., because of insufficient capital gains and/or significant capital loss carryforwards), generally may be carried forward to offset future capital gains, if any.

Wealthfront only monitors for tax-loss harvesting for accounts within Wealthfront. The client is responsible for monitoring their and their spouse’s accounts outside of Wealthfront to ensure that transactions in the same security or a substantially similar security do not create a “wash sale.” A wash sale is the sale at a loss and purchase of the same security or substantially similar security within 30 days of each other. If a wash sale transaction occurs, the IRS may disallow or defer the loss for current tax reporting purposes. More specifically, the wash sale period for any sale at a loss consists of 61 calendar days: the day of the sale, the 30 days before the sale, and the 30 days after the sale. The wash sale rule postpones losses on a sale, if replacement shares are bought around the same time.

The effectiveness of the tax-loss harvesting strategy to reduce the tax liability of the client will depend on the client’s entire tax and investment profile, including purchases and dispositions in a client’s (or client’s spouse’s) accounts outside of Wealthfront and type of investments (e.g., taxable or nontaxable) or holding period (e.g., short- term or long-term). Except as set forth below, Wealthfront will monitor only a client’s (or client’s spouse’s) Wealthfront accounts to determine if there are unrealized losses for purposes of determining whether to harvest such losses. Transactions outside of Wealthfront accounts may affect whether a loss is successfully harvested and, if so, whether that loss is usable by the client in the most efficient manner.

A client may also request that Wealthfront monitor the client’s spouse’s accounts or their IRA accounts at Wealthfront to avoid the wash sale disallowance rule. A client may request spousal monitoring online or by calling Wealthfront at 844-995-8437. If Wealthfront is monitoring multiple accounts to avoid the wash sale disallowance rule, the first taxable account to trade a security will block the other account(s) from trading in that same security for 30 days.

Wealthfront may lack visibility to certain wash sales, should they occur as a result of external or unlinked accounts, and therefore Wealthfront may not be able to provide notice of such wash sale in advance of the Client’s receipt of the IRS Form 1099.

About the author(s)

Andy Rachleff is Wealthfront's co-founder and Executive Chairman. He serves as a member of the board of trustees and chairman of the endowment investment committee for University of Pennsylvania and as a member of the faculty at Stanford Graduate School of Business, where he teaches courses on technology entrepreneurship. Prior to Wealthfront, Andy co-founded and was general partner of Benchmark Capital, where he was responsible for investing in a number of successful companies including Equinix, Juniper Networks, and Opsware. He also spent ten years as a general partner with Merrill, Pickard, Anderson & Eyre (MPAE). Andy earned his BS from University of Pennsylvania and his MBA from Stanford Graduate School of Business. View all posts by Andy Rachleff