Note: As of October 2023, the Wealthfront Cash Account now offers up to $8 million in FDIC insurance through our partner banks.

Whenever interest rates decline, as they are expected to do at the end of this month, you are sure to see a slew of articles published that encourage consumers to forego immediate access to their money in favor of maintaining a higher rate of interest. Ally Bank and Goldman Sachs’ Marcus recently decided to lower the rates they pay on their liquid savings accounts, which has driven the latest round of what we think is terrible advice. Many of the recent pieces have encouraged readers to consider using Certificates of Deposit (“CDs”) as a compelling alternative to a liquid savings account to maintain their interest rates.

While there’s obvious surface appeal to a fixed interest rate that’s typically higher than what you’ll see on a savings account, there are serious reasons to take pause before thinking that putting your money in a CD is the safest way to ride out falling interest rates.

Some background: a Certificate of Deposit (CD) is a savings certificate with a fixed maturity date and specified fixed interest rate that can be issued in any denomination aside from minimum investment requirements. CDs are generally issued by commercial banks and are insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000 per individual. Term lengths — the length of time you agree to leave your deposit in the bank — on CDs usually range from a few months up to 10 years. Withdrawals made before the maturity are most likely subject to penalties.

CDs are meant for money you don’t plan on needing in the short term.

Liquidity, as you likely know, is the term we use to refer to how quickly you can get access to your cash assets. It is an extremely important factor to consider when deciding where to save your cash. In fact, liquidity is one of the two key things everyone must think about when deciding how much of their money to put into what kinds of accounts at various times: accessibility and interest rate.

Here’s how the relationship between these two factors typically works out: The longer your money is locked up, the higher the rate you should be paid. But earning a higher rate may not be a higher priority than liquidity for your particular situation. For example, if you are saving for a home that you want to purchase in the next year or so, you would be ill-advised to lock your money up in the meantime, even if just for a year. What if your ideal home comes on the market in nine months, and you’re unable to access your savings to make your down payment? Similarly, it might seem like a great idea to put your emergency fund in an account that earns a higher rate, but if that rate comes with the stipulation that the funds are locked up for a set period of time, that money is not of much value if the emergency for which you saved occurs in the interim.

The fact is, high interest rates are wonderful — as long as you still have access to the cash you need when you need it.

Let’s compare the numbers.

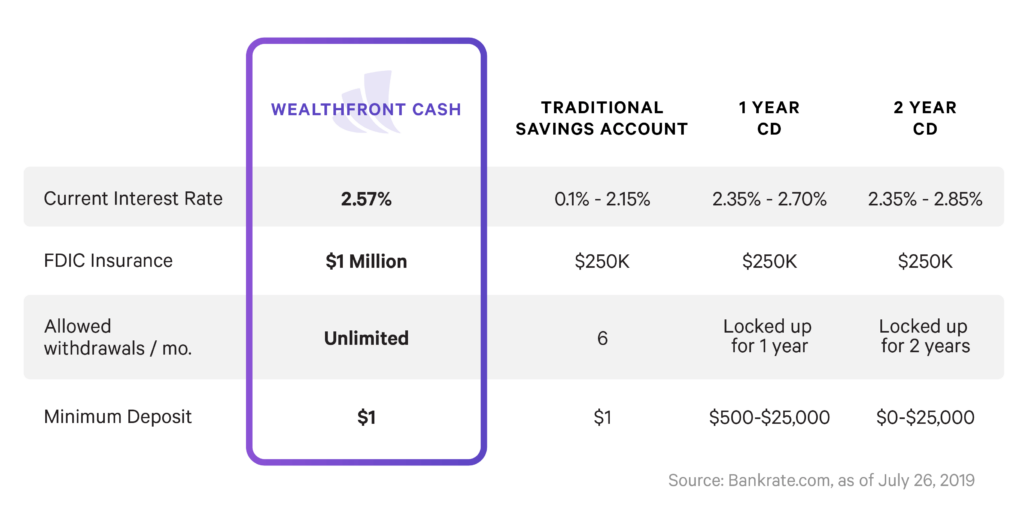

Since interest rates are correlated with duration of CDs, you typically find that you earn a higher rate for a longer required lockup period. This is born out in the table below that compares a fully liquid Wealthfront Cash Account to a traditional savings account, a one-year CD, and a two-year CD. As you can see, the rates on CDs are much higher than what you can get from a traditional savings account, but they require your money to be locked up for the term length, and they usually also require a hefty minimum account size (typically the higher the minimum, the higher the rate).

This isn’t to say that CDs are inherently a bad option. That’s far from the truth. A CD can be an appropriate destination for your cash, but only if you’re certain you don’t need the money for that time period, and the CD pays a significant earnings advantage compared to available liquid alternatives. Think of every expense you might need cash for in the next few years — those funds may not be better off in a CD, and a cut to interest rates doesn’t change that. Again, it’s about balancing accessibility and growth potential, the two pillars of cash allocation.

So how much of an interest rate advantage does a CD need to offer in order to be worth opting for it versus a high-yield cash account?

The amount of premium needed is subject to personal tastes, but it’s very hard to say that current one- and two-year CDs are justified over what Wealthfront’s Cash Account offers, especially when you take account minimums into consideration. And honestly, even for money you don’t need in the next few years, a CD still might not be the best option.

It’s also worth remembering that savings accounts and CDs are not your only choices. Let’s say you have a chunk of cash that you don’t plan to use for at least three to five years. In that case, a diversified investment account is likely a better option than a CD. Current rates on CDs are not much higher than the current inflation rate, so you are not necessarily gaining any meaningful buying power by saving your cash there. A way to grow your buying power is to invest in an equity oriented diversified portfolio. This isn’t our advice because Wealthfront offers a portfolio like this — we offer it because it’s such a favorable option for our clients to house the funds they don’t need near-term access to. Based on historical performance, the expected annual long-term net of fee return associated with an investment account (not including the benefits of tax-loss harvesting) could be as high as 10%, which more than justifies the risk if these funds are left alone for at least three to five years.

Each type of savings account has a particular intended use case. This is an immovable fact that gets diluted by reactionary advice encouraging consumers to run from one high interest rate to the next without thoughtful, strategic consideration about what their actual needs are, including determining the amount of liquidity that they personally need. This important nuance so often gets ignored in financial advice tied to market events like rate cuts. So before you get enticed by the slightly higher rates offered by CDs, take a moment to digest all the options, weigh your own needs and priorities, and then decide what moves to make, if any.

Disclosure

This blog is powered by Wealthfront Software LLC (“Wealthfront”) and has been prepared solely for informational purposes only. Nothing in this communication should be construed as an offer, recommendation, or solicitation to buy or sell any security or a financial product. Any links provided to other server sites are offered as a matter of convenience and are not intended to imply that Wealthfront Advisers or its affiliates endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Cash Account is offered by Wealthfront Brokerage LLC (“Wealthfront Brokerage”), a member of FINRA/SIPC. Neither Wealthfront Brokerage nor its affiliates is a bank. We convey funds to institutions accepting and maintaining deposits. Investment management and advisory services are provided by Wealthfront Advisers LLC (“Wealthfront Advisers”), an SEC registered investment adviser, and financial planning tools are provided by Wealthfront Software LLC (“Wealthfront”).

The Wealthfront Cash Account Annual Percentage Yield (APY) is as of [May 28, 2019]. The APY may change at any time, before or after the Cash Account is opened. The national average according to Bankrate: 0.10% APY, as of July 26, 2019.

The cash balance in the Cash Account is swept to one or more banks (the “program banks”) where it earns a variable rate of interest and is eligible for FDIC insurance. FDIC insurance is not provided until the funds arrive at the program banks. FDIC insurance coverage is limited to $250,000 per qualified customer account per banking institution. Wealthfront uses more than one program bank to ensure FDIC coverage of up to $8 million for your cash deposits. For more information on FDIC insurance coverage, please visit www.FDIC.gov. Customers are responsible for monitoring their total assets at each of the program banks to determine the extent of available FDIC insurance coverage in accordance with FDIC rules. The deposits at program banks are not covered by SIPC.

Nothing in this communication should be construed as tax advice, a solicitation or offer, or recommendation, to buy or sell any security.

All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Please see our Full Disclosure for important details.

Wealthfront Advisers and Wealthfront Brokerage are wholly owned subsidiaries of Wealthfront Corporation.

© 2019 Wealthfront Corporation. All rights reserved.

About the author(s)