Managing your money should be easy, but it usually isn’t. If you’re like half of Americans and keep your money at more than one financial institution, you probably find yourself moving money between accounts, committing multiple logins to memory, and monitoring lots of transfers. Whether you use traditional banks, fintech companies, or a mix to manage your money, it can be exhausting to coordinate across clunky interfaces that don’t work well together. This hassle is what inspired our vision of Self-Driving Money™.

For years, we’ve worked towards building a future where software would make it easy to manage your finances automatically – so they’d become a point of pride, not a source of stress. We’re thrilled to announce that Self-Driving Money™ is finally here. The Wealthfront Cash Account now allows you to instantly organize your cash into categories and route your money exactly where you want it, so you can effortlessly manage your finances from end to end.

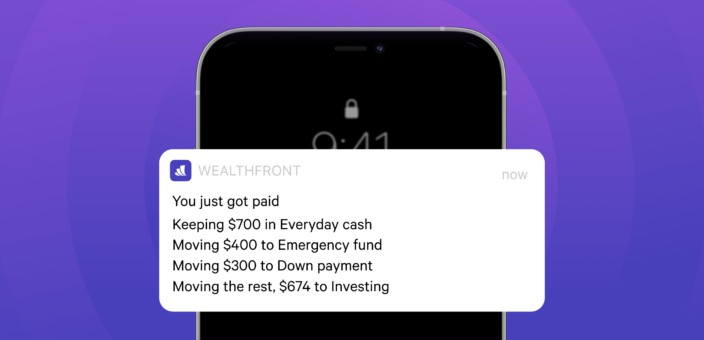

From the moment your employer direct deposits your paycheck to your Cash Account, you can let our software handle the details – it will automatically keep money for everyday spending (like paying bills), send checks as needed, top off your emergency fund and other savings goals, and even invest money within minutes so you can build long-term wealth. When you build your savings plan, we’ll apply our industry-leading automation so your money gets routed automatically with no extra effort on your part. It’s a whole new way to make your money work for you.

You make the rules, we’ll automate them

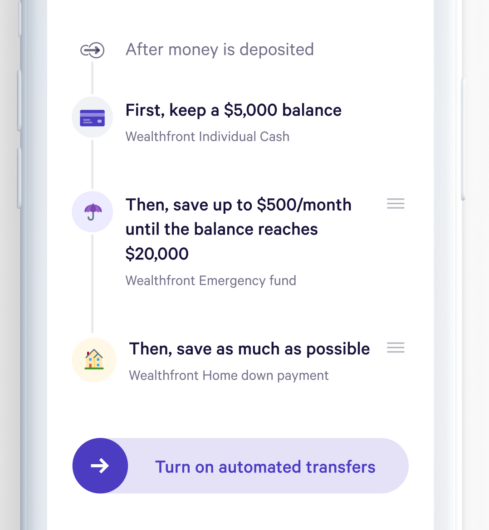

It takes just a few taps to organize your cash into categories and build an automated plan to route your paycheck – both are extremely flexible and you can edit them at any time. For example, let’s say you want a category to save up an emergency fund (which we think is a great idea!). You can set a target total balance for your emergency fund (or a monthly saving target) and our software will automatically move money to meet that goal while ensuring you have enough for everyday spending.

Of course, you’re probably saving for more than one thing. Our software takes the work out of routing money to multiple goals. In addition to saving for an emergency fund, maybe you also want to save for the down payment on a home. You can create another category and update your plan so that cash gets automatically routed to both categories instantly to meet your specific needs. You might also decide you want all excess cash to go to your emergency fund until you hit your target balance, and then start saving for a down payment – that’s fine, too, and it’s easy to set up.

At Wealthfront, we want to save you both time and stress by simplifying the way you manage your money. Our Cash Account offers all of the checking features you expect, plus the sophisticated automation you need to effortlessly route your money exactly where you want it. And when you’re ready to transfer your long-term savings to a Wealthfront Investment Account, your money can be invested within minutes.

Self-Driving Money™ is here

We’re unbelievably excited that Self-Driving Money™ is now a reality, making Wealthfront the ideal home for your cash and investments. That doesn’t mean our work is done, though. Very soon, we’ll be rolling out even more features that give you additional control and personalization in how you manage your money. We have big things planned for 2021, and we can’t wait to show them to you.

Disclosure

We’ve partnered with Green Dot Bank, Member FDIC, to bring you checking features.

Checking features for the Cash Account are subject to identity verification by Green Dot Bank. Debit Card is optional and must be requested. Green Dot Bank operates under the following registered trade names: GO2bank, GoBank, Green Dot Bank and Bonneville Bank. All of these registered trade names are used by, and refer to, a single FDIC-insured bank, Green Dot Bank. Deposits under any of these trade names are deposits with Green Dot Bank and are aggregated for deposit insurance coverage. Wealthfront products and services are not provided by Green Dot Bank. Green Dot is a registered trademark of Green Dot Corporation. ©2021 Green Dot Corporation. All rights reserved.

Other eligibility requirements for mobile check deposit and to send a check may apply. Please see the Deposit Account Agreement for details.

Cash Account is offered by Wealthfront Brokerage LLC (“Wealthfront Brokerage”), a Member of FINRA/SIPC. Neither Wealthfront Brokerage nor any of its affiliates are a bank, and Cash Account is not a checking or savings account. We convey funds to partner banks who accept and maintain deposits, provide the interest rate, and provide FDIC insurance. Investment management and advisory services–which are not FDIC insured–are provided by Wealthfront Advisers LLC (“Wealthfront Advisers”), an SEC-registered investment adviser, and financial planning tools are provided by Wealthfront Software LLC (“Wealthfront”).

The information contained in this communication is provided for general informational purposes only, and should not be construed as investment or tax advice. Nothing in this communication should be construed as a solicitation or offer, or recommendation, to buy or sell any security. Any links provided to other server sites are offered as a matter of convenience and are not intended to imply that Wealthfront Advisers or its affiliates endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Please see our Full Disclosure for important details.

Wealthfront Advisers, Wealthfront Brokerage and Wealthfront are wholly owned subsidiaries of Wealthfront Corporation.

© 2021 Wealthfront Corporation. All rights reserved.

About the author(s)

The Wealthfront Team believes everyone deserves access to sophisticated financial advice. The team includes Certified Financial Planners (CFPs), Chartered Financial Analysts (CFAs), a Certified Public Accountant (CPA), and individuals with Series 7 and Series 66 registrations from FINRA. Collectively, the Wealthfront Team has decades of experience helping people build secure and rewarding financial lives. View all posts by The Wealthfront Team