Note: As of November 3, 2023, the Wealthfront Cash Account has a 5.00% APY. Read more about it here .

It’s no secret that inflation, or an increase in the price of goods and services, has been unusually high for much of 2022. While it’s always important to get the most out of your savings, it’s especially important to do so when inflation is high and your cash is at a much greater risk of losing buying power.

Your cash loses buying power when it has a negative “real” return — real return is your nominal return (the stated rate on your savings or cash account) minus the rate of inflation. Cash seldom has a positive real return even when inflation is low, but the issue becomes much more serious when inflation is at historic levels.

In this post, we’ll explain exactly how you can maximize the value of your cash savings when inflation is high.

Earn a high APY on your cash

Pretty much everyone will find it necessary to hold at least some cash for everyday expenses and an emergency fund, so it’s important to have a plan to maximize the value of that cash. An easy way to do this is to make sure it’s earning a high APY.

You’ll find there’s a big range in terms of the APYs various financial institutions will pay you. Currently, the average savings account only pays 0.17% APY according to FDIC.gov, but Wealthfront’s Cash Account pays a staggering 2.55%. (Other financial institutions could pay you this much, too — they just choose not to.)

While your cash is unlikely to earn enough to keep up with inflation even with a high rate like Wealthfront’s, every little bit helps. Consider that $10,000 will earn $254.93 in interest over the course of a year at a 2.55% APY (assuming monthly compounding), whereas the same $10,000 will only earn $17.01 at a 0.17% APY. The 2.55% APY won’t be enough to keep all of your buying power, but it still earns you $237.92 more than you’d get otherwise. If you can avoid paying any account fees on your cash, your short-term savings will stretch even further. Keep your cash at a financial institution that pays a high APY and charges no fees to maximize your earnings. You should also make sure your cash is protected by FDIC insurance.

Hold only the cash you need and invest the rest

Holding some cash is essential, but too much is a problem. Many people feel as if they should hold onto more cash than usual during uncertain economic times, but periods of high inflation are actually some of the worst times to keep a bunch of extra cash around. We recommend you hold only enough cash to cover the following:

- Money to cover the current month’s expenses like rent, groceries, and other bills.

- An adequate emergency fund, which is usually 3-6 months’ worth of expenses. Where you fall within the 3-6 month range will depend on your age, profession, total investable assets, and the likelihood that you’ll encounter other financial responsibilities (for example, providing financial support to a family member).

- Whatever money you are saving for short-term goals. We define a short-term goal as one occurring within the next 3-5 years. (You can check out this blog post for more detail on saving for long-term vs. short-term goals.)

Anything beyond that is likely too much, and this excess cash can hurt you. Holding too much cash leads to what’s known as cash drag.

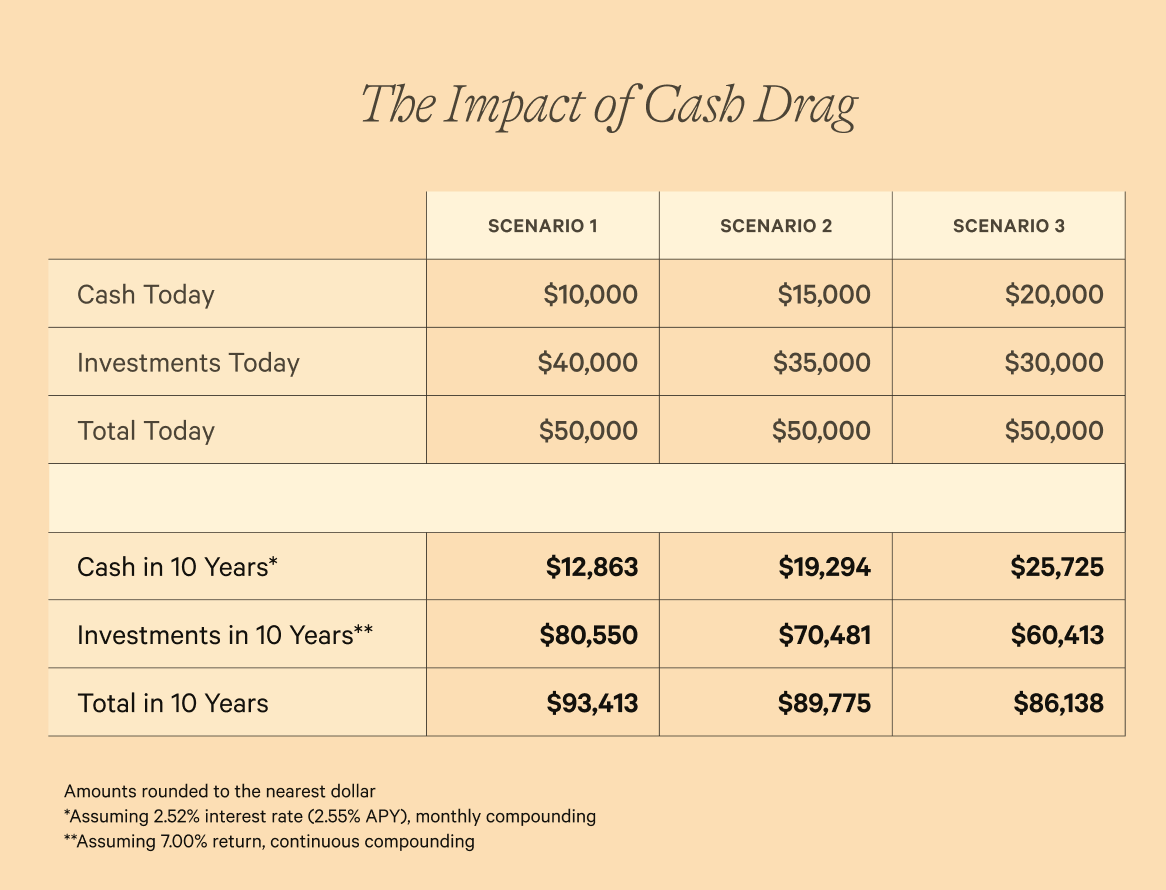

Cash drag happens when your cash savings lose their real value due to the effects of inflation, which in turn hurts your overall wealth. The solution is to invest, even if you feel concerned about short-term market conditions. For example, let’s say you have $50,000 in savings, only $10,000 of which you need for your emergency fund and other short-term goals and expenses. Let’s assume you can earn a 2.55% APY or 2.52% interest rate on your cash (although few banks will actually pay you this much right now) and 7% annual returns on your investments (which is a reasonable guess over the long term). For simplicity, we’ll ignore the impact of fees and taxes. The table below shows the total value of your holdings after 10 years depending on whether you held the right amount of cash, $5,000 too much, or $10,000 too much over that time period. As you can see, holding more cash than you need over 10 years can have a dramatic negative impact on the total value of your portfolio in the form of thousands of dollars of lost returns.

Cash drag is a perennial issue for investors, but it’s especially problematic when inflation is high. That’s because, as we mentioned above, the APY on even a high-yield cash account is unlikely to keep up with inflation, whereas an investment portfolio has historically been more likely to do so over the long term. As a result, the cash you hold will buy you less and less over time.

The U.S. Bureau of Labor Statistics has a calculator that can help you visualize this loss of buying power. Consider, for example, that $1,000 20 years ago (in August of 2002) had buying power equivalent to $1,639.02 today. In other words, if someone gave you $1,000 in 2002 and you held it in cash for two decades, you’d now need another $639.02 to have the same buying power you had 20 years ago. Meanwhile, if you had invested that $1,000 for 20 years at a 7% annual rate of return, you’d have $4,055.20 before taxes — more than enough to keep up with inflation.

We know many investors are reluctant to put money in the market at a time when it seems like there may be a recession on the horizon. It’s tempting to hold more cash as a security blanket because earning a 2.55% APY might sound pretty good compared to having your investments potentially lose value in the short term. Unfortunately, this approach is misguided.

We conducted an analysis that measured the time it takes for bear markets (market declines of 20% or more) to recover. On average, we found the mean time to recovery for bear markets between 1965 and 2019 was 654 days, or about 1.8 years (this actually excludes the 2020 bear market, which was the shortest in the history of the S&P 500). In other words, history shows that investors who stayed invested from the bottom of a bear market have earned on average at least 20% returns in 1.8 years as the market returns to its pre-bear market level, which is very attractive — much more so than even a market-leading APY like what we pay on our Cash Account. Of course, it’s virtually impossible to know ahead of time when the market will bottom out, so your best bet is to invest even when market conditions seem bad so you’ll have an opportunity to benefit from the eventual recovery.

Get the most out of your cash

There’s no getting around it: when inflation is high, your cash is likely to lose buying power. Since you’ll need some cash on hand for everyday expenses, short-term goals, and an emergency fund, it’s important to build a plan to maximize its value. That plan doesn’t have to be complicated — you just have to find a good home for your cash and avoid the temptation to hold too much of it.

We recommend choosing a high-yield account like the Wealthfront Cash Account — it currently offers a 2.55% APY and has absolutely no account fees. Our Cash Account also comes with up to $8 million in FDIC insurance through our partner banks (32x what you’d get from a traditional bank) and unlimited fee-free transfers so your money is well protected and readily accessible. And when you’re ready to invest (both to build long-term wealth and avoid cash drag), you can invest in an award-winning Wealthfront Automated Investing Account within minutes during market hours.

Disclosure

We’ve partnered with Green Dot Bank, Member FDIC, to bring you checking features.

Checking features for the Cash Account are subject to identity verification by Green Dot Bank. Debit Card is optional and must be requested. Wealthfront Cash Account Visa(Registered TM) Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. Visa is a registered trademark of Visa International Service Association. Green Dot Bank operates under the following registered trade names: GO2bank, GoBank, Green Dot Bank and Bonneville Bank. All of these registered trade names are used by, and refer to, a single FDIC-insured bank, Green Dot Bank. Deposits under any of these trade names are deposits with Green Dot Bank and are aggregated for deposit insurance coverage. Wealthfront products and services are not provided by Green Dot Bank. Green Dot is a registered trademark of Green Dot Corporation. Copyright 2022 Green Dot Corporation. All rights reserved.

Other fees apply to the checking features. Fee-free ATM access applies to in-network ATMs only. For out-of-network ATMs and bank tellers a $2.50 fee will apply, plus any additional fee that the owner or bank may charge. Other eligibility requirements for mobile check deposit and to send a check may apply. Please see the Deposit Account Agreement for details.

Cash Account is offered by Wealthfront Brokerage LLC (“Wealthfront Brokerage”), a Member of FINRA/SIPC. Neither Wealthfront Brokerage nor any of its affiliates are a bank, and Cash Account is not a checking or savings account. We convey funds to partner banks who accept and maintain deposits, provide the interest rate, and provide FDIC insurance. Investment management and advisory services–which are not FDIC insured–are provided by Wealthfront Advisers LLC (“Wealthfront Advisers”), an SEC-registered investment adviser, and financial planning tools are provided by Wealthfront Software LLC (“Wealthfront”).

The Annual Percentage Yield (APY) for the Cash Account may change at any time, before or after the Cash Account is opened. The APY for the Wealthfront Cash Account represents the weighted average of the APY on the aggregate deposit balances of all clients at the program banks. Deposit balances are not allocated equally among the participating program banks.

The information contained in this communication is provided for general informational purposes only, and should not be construed as investment or tax advice. Nothing in this communication should be construed as tax advice, a solicitation or offer, or recommendation, to buy or sell any security. Any links provided to other server sites are offered as a matter of convenience and are not intended to imply that Wealthfront Advisers or its affiliates endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Wealthfront, Wealthfront Advisers and Wealthfront Brokerage are wholly owned subsidiaries of Wealthfront Corporation.

Copyright 2022 Wealthfront Corporation. All rights reserved.

About the author(s)

Tony Molina is a Product Evangelist at Wealthfront. He is a Certified Public Accountant (CPA) and holds Series 66 and Series 7 licenses from FINRA. View all posts by Tony Molina, CPA