Last year was challenging for financial markets. At Wealthfront, we know it can be gut-wrenching to watch the value of your investing account decline, even if it’s only temporary. However, if you were a Wealthfront client in 2022, all of that volatility had a significant silver lining in the form of Tax-Loss Harvesting. Last year alone, Wealthfront harvested $1.5 billion of losses to help clients lower their taxes (with $2.8 billion harvested over the last five years and nearly $3.2 billion over the life of the service). If you multiply that $1.5 billion in harvested losses by an assumed marginal tax rate of 37.5%, you get an estimated $562.5 million in potential tax savings for Wealthfront clients last year.

Here are more high-level results at a glance:

- After-tax benefit in 2022: If you used Tax-Loss Harvesting in a Classic portfolio in 2022, our service harvested enough losses across all client vintages and risk scores to generate average estimated potential tax savings equal to 3.75% of your account value, or 15 times the 0.25% annual advisory fee¹ we charge (assuming a 37.5% marginal tax rate).

- After-tax benefit since the service was founded: If you use Tax-Loss Harvesting in a Classic portfolio, our software has harvested enough losses to generate average annual estimated potential tax savings worth 2.88% of your portfolio value since we began offering the service (assuming a 37.5% marginal tax rate). This translates to an estimated annual after-tax benefit worth 11 times our 0.25% annual advisory fee.

As big believers in transparency, we think it’s important to publish the results of our Tax-Loss Harvesting service so you can clearly see the benefit it offers, and we’re proud to be the only robo-advisor to do this. You shouldn’t necessarily assume other tax-loss harvesting services will offer the same benefit as Wealthfront’s—not all tax-loss harvesting software is the same, and we’ve worked hard to build what we believe is the best on the market.

In this post, we’ll take a more detailed look at how Wealthfront’s Tax-Loss Harvesting performed through the end of 2022.

How tax-loss harvesting works

Before we dive into the results, here’s a quick review of how tax-loss harvesting works. Tax-loss harvesting is a tax deferral and tax-minimization strategy where you sell investments that have declined below their purchase price and replace them with similar investments. When you do this, your portfolio retains the same general risk and return characteristics, but you get to “harvest” a loss. When tax time rolls around, you can use those losses to offset capital gains. If you have leftover losses once you’ve offset your realized gains, you can then offset up to $3,000 of ordinary income for the year. If you have losses left over after that, you can use them in future years.

One way tax-loss harvesting saves you money is through tax deferral, where you push paying your taxes into the future. Tax deferral is valuable because of the time value of money. Put simply, if you have the choice between paying taxes today and paying them years in the future, it’s usually advantageous to pay them in the future (assuming your tax rate does not rise significantly in that time) because money you save on taxes today can be reinvested and thus has the potential to be worth more down the road when you do eventually pay taxes.

Contrary to what some people may believe, tax-loss harvesting is not just tax deferral, however. For many people, it’s also a tax minimization strategy in the form of tax-rate arbitrage. That’s because tax-loss harvesting can allow you to offset short-term capital gains (which are typically taxed as ordinary income, which for the highest tax bracket currently has a maximum federal rate of 37%) today and pay long-term capital gains rates (which currently top out at 20% at the federal level) when you eventually sell your investments in the future, as long as you hold them for at least a year. Keep in mind that your ability to do this depends on your future tax rates and when you decide to sell your investments.

How Wealthfront’s Tax-Loss Harvesting performed in 2022

To measure the benefit of Wealthfront’s Tax-Loss Harvesting, we use what we call “harvesting yield.” Harvesting yield takes the amount of harvested losses in a given year and divides that number by the portfolio’s value at the beginning of the year. Higher harvesting yield means our software found and took advantage of more opportunities to harvest losses—and 2022 was an excellent year for harvesting yield.

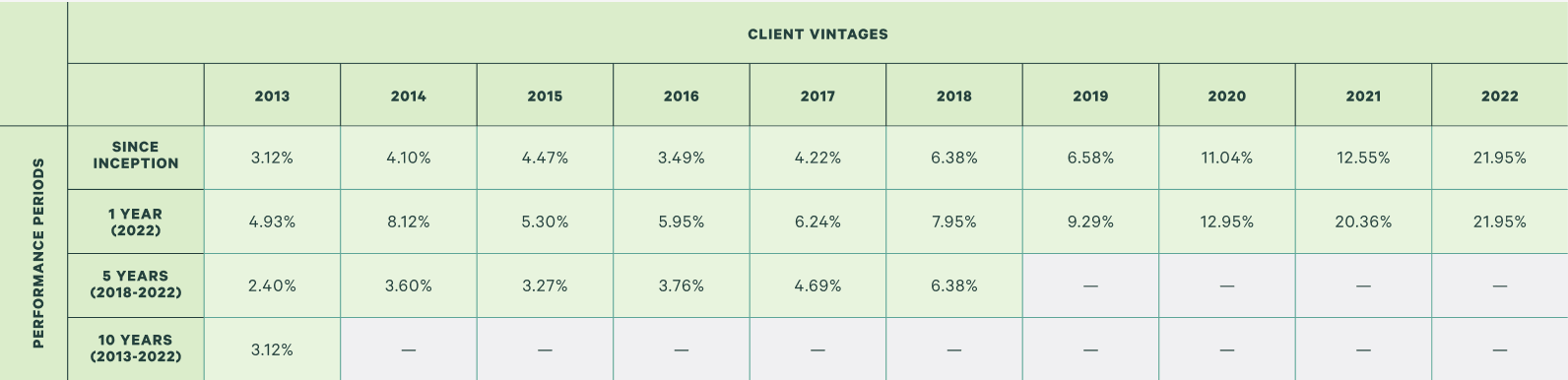

The table below shows average annual harvesting yield for clients with a Classic portfolio with a risk score of 8 (the risk score most commonly chosen by clients using Tax-Loss Harvesting), sorted by “client vintage” or the year they first started using our Tax-Loss Harvesting. As you can see, Wealthfront’s software has harvested significant losses across client vintages and performance periods, all with the goal of helping you lower your tax bill. As you read the chart below, keep in mind that harvesting yield naturally tends to decline over time, which is why the numbers for the five- and ten-year performance periods are lower. The reason? If the value of your investments rises over time, it becomes less likely those investments will decline below their purchase price and give our software an opportunity to harvest a loss. Making frequent additional deposits to your investing account can help keep your harvesting yield high over time.

Average annual harvesting yield for risk score 8 Classic portfolios through 2022

The table above focuses on risk score 8 portfolios because they are the most common among our clients using Tax-Loss Harvesting. But our software has harvested significant losses for clients with less popular risk scores, too. The dollar-weighted average annual harvesting yield for clients using Tax-Loss Harvesting in a Classic portfolio across all vintages and all risk scores is 7.69% since inception, 3.93% over the last 5 years, and 10.01% over the last year. We can translate harvesting yield into estimated annual after-tax benefit by multiplying harvesting yield by 37.5%, the middle of the range of marginal tax rates we estimate our clients could pay (25-50%). This means the dollar-weighted average annual after-tax benefit for all clients using Tax-Loss Harvesting in a Classic portfolio of any client vintage and risk score since the service’s inception is 2.88%, which is over 11 times Wealthfront’s annual advisory fee. In short, Tax-Loss Harvesting generates potential after-tax benefit that can significantly outweigh the cost of our service.

The analysis above only includes Classic portfolios (our most popular portfolio), but it’s important to note that our Socially Responsible portfolio has had very similar harvesting yield results:

- The average annual harvesting yield for all Socially Responsible portfolios across risk scores and client vintages in 2022 was 24.91% (vs. 22.29% for our Classic portfolio).

- The average annual harvesting yield for all Socially Responsible portfolios across risk scores and client vintages since the portfolios’ inception in late 2021 was 23.14% (vs. 20.69% for Classic portfolios over the same period).

If you had a customized portfolio at Wealthfront, you also continued to benefit from Tax-Loss Harvesting in 2022:

- The average annual harvesting yield for all customized portfolios at Wealthfront across client vintages in 2022 was 21.73%.

- The average annual harvesting yield for all customized portfolios at Wealthfront across client vintages since the inception of custom portfolios at Wealthfront in mid-2021 was 17.90%.

How much benefit you’ll get from Tax-Loss Harvesting

All of the figures presented above are averages, and it’s important to remember that you could receive more or less benefit from Tax-Loss Harvesting depending on a few factors, including:

- The riskiness of your portfolio. Riskier portfolios are generally more volatile, and more volatility usually means there are more opportunities to harvest losses.

- When you make deposits. If you make one large deposit and never add more, it becomes harder to harvest losses over time. Frequent add-on deposits, however, mean you’ll have more tax lots in your portfolio and it’s more likely our software will be able to harvest losses.

- Your marginal tax rate. The higher your marginal tax rate, the more you’ll save when you use losses to offset taxable gains. If you live in a high tax state and have a high income, you’re likely to get more benefit than someone in a lower tax bracket in a lower tax state.

- Your ability to use losses. You might not realize enough capital gains each year to use all of your harvested losses. You might even have unused losses after offsetting up to $3,000 of ordinary income. That’s okay—you can roll unused losses over to future years.

- Wash sales. Occasionally, some benefit from Tax-Loss Harvesting can be lost to wash sales. Wash sales are relatively rare at Wealthfront (they affect about 0.15% of trades excluding withdrawals) because our software is designed to avoid them across all of your Automated Investing accounts with us. In the event of a wash sale, it’s not the end of the world—you just have to wait a year to realize the loss associated with that transaction.

- Suitable alternates. Some investments offered at Wealthfront aren’t eligible for Tax-Loss Harvesting because we don’t have suitable alternate ETFs available for them, which can lower your harvesting yield. You can always check to see if an ETF available at Wealthfront has a Tax-Loss Harvesting alternate by searching for specific investments here.

Tax-Loss Harvesting is a great job for software

At Wealthfront, we use software and automation to save you time and money. While you could theoretically do tax-loss harvesting for yourself, it would be a significant effort and it’s unlikely you’d check for opportunities to harvest losses each day like our software does (meaning your harvesting yield and thus your after-tax benefit would probably be lower).

We’re delighted to offer our Tax- Loss Harvesting service in all taxable Automated Investing Accounts, including ones that have been customized, at no extra cost. This powerful tax-minimization strategy is just one of the many ways we help you build long-term wealth on your own terms.

¹ This reflects the estimated total annualized after-tax benefit from Tax-Loss Harvesting relative to our 0.25% advisory fee. The calculation was made using clients enrolled in Wealthfront’s Classic Automated Investing portfolios using Tax-Loss Harvesting from 2013 through 2022.

Disclosure

The information contained in this communication is provided for general informational purposes only, and should not be construed as investment or tax advice. Nothing in this communication should be construed as a solicitation, offer, or recommendation, to buy or sell any security. Any links provided to other server sites are offered as a matter of convenience and are not intended to imply that Wealthfront Advisers or its affiliates endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

The effectiveness of the Tax-Loss Harvesting strategy to reduce the tax liability of the client will depend on the client’s entire tax and investment profile, including purchases and dispositions in a client’s (or client’s spouse’s) accounts outside of Wealthfront Advisers and type of investments (e.g., taxable or nontaxable) or holding period (e.g., short- term or long-term).Tax loss harvesting may generate a higher number of trades due to attempts to capture losses. There is a chance that trading attributed to tax loss harvesting may create capital gains and wash sales and could be subject to higher transaction costs and market impacts. In addition, tax loss harvesting strategies may produce losses, which may not be offset by sufficient gains in the account and may be limited to a $3,000 deduction against income. The utilization of losses harvested through the strategy will depend upon the recognition of capital gains in the same or a future tax period, and in addition may be subject to limitations under applicable tax laws, e.g., if there are insufficient realized gains in the tax period, the use of harvested losses may be limited to a $3,000 deduction against income and distributions. Losses harvested through the strategy that are not utilized in the tax period when recognized (e.g., because of insufficient capital gains and/or significant capital loss carryforwards), generally may be carried forward to offset future capital gains, if any.

Investment management and advisory services–which are not FDIC insured–are provided by Wealthfront Advisers LLC (“Wealthfront Advisers”), an SEC-registered investment adviser, and financial planning tools are provided by Wealthfront Software LLC (“Wealthfront”). Brokerage products and services are offered by Wealthfront Brokerage LLC, member FINRA/SIPC. All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Please see our Full Disclosure for important details.

Wealthfront Advisers, Wealthfront Brokerage and Wealthfront are wholly owned subsidiaries of Wealthfront Corporation.

© 2023 Wealthfront Corporation. All rights reserved.

About the author(s)

Fang Rui is a Chartered Financial Analyst (CFA) and an investment researcher at Wealthfront. Prior to Wealthfront, Fang spent nearly a decade at BlackRock where she worked in ETF and index research as well as risk management. She earned a Master of Science in Industrial Engineering and Operations Research from University of California, Berkeley and earned a Bachelor of Science in Engineering with a major in Operations Research and Financial Engineering from Princeton University. View all posts by Fang Rui, CFA