2019 was kind to investors, but 2020 has come with its ups and downs. After a record-setting start to the year, the tides turned quickly as news of the coronavirus COVID-19 made headlines. During a three-week window from February 19 to March 11, the Dow and S&P 500 tumbled into bear market territory. On March 15, the Federal Reserve lowered the target range for the federal funds rate by a full percentage point and announced plans to purchase $700 billion of assets as part of a quantitative easing program. The result? More investor fear (as measured by the CBOE Volatility Index) than we’ve seen in more than a decade.

Just as we have seen during previous bear markets (and market corrections), many individual investors sell when the market declines out of fear it will never come back. However, the opposite is actually true. Not only will the market come back, but history has shown that it will do so a lot sooner than you might think. While we can’t predict the future, we can certainly use the past to help inform how we think about times of unusually high volatility. So in this post we’ll present data on how market corrections and bear markets work so you can come in off the sidelines and keep investing in your future.

Bearing the bear

Because the market was on a tear, investors have been sensitive to any downward trends. So when the latest bear market — defined as a peak-to-trough decline of at least 20% — occurred last week, it sent shockwaves. The result has been fear and uncertainty, with many investors pulling the money out of the market or keeping their money in savings while they wait it out. But just how long should this last?

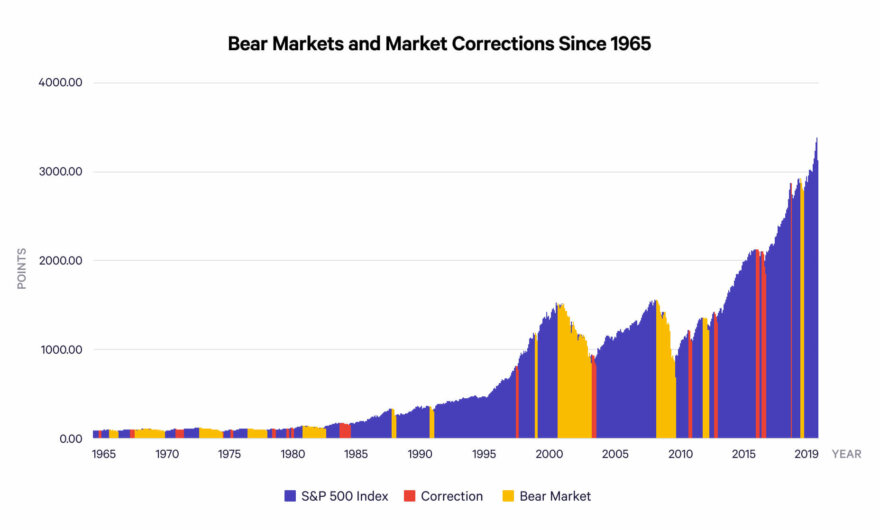

Since the current bear market is still in progress, we’ll exclude that from our analysis here. As you can see from the chart below, since 1965, there have been 17 market corrections (defined as a peak-to-trough decline of 10%) and 12 bear markets. For the purpose of this analysis we rounded up declines to determine corrections and bear markets:

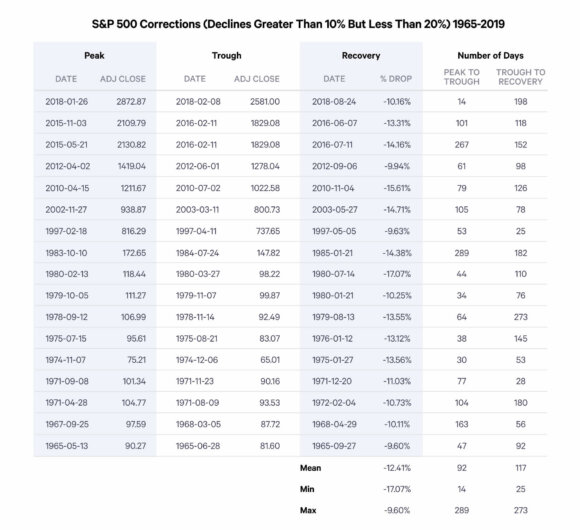

The table below displays the size of each correction and the amount of time it took the market to recover, or the time it took to return to the price achieved at the peak.

As you can see the mean time to recovery from a market correction was only 117 days, which isn’t that long of a time to exercise patience when you’re investing for the long term. Yet numerous research organizations, most notably DALBAR, have found that individual investors consistently run for the exits whenever the market drops, which on average costs them as much as 3.5% per year.

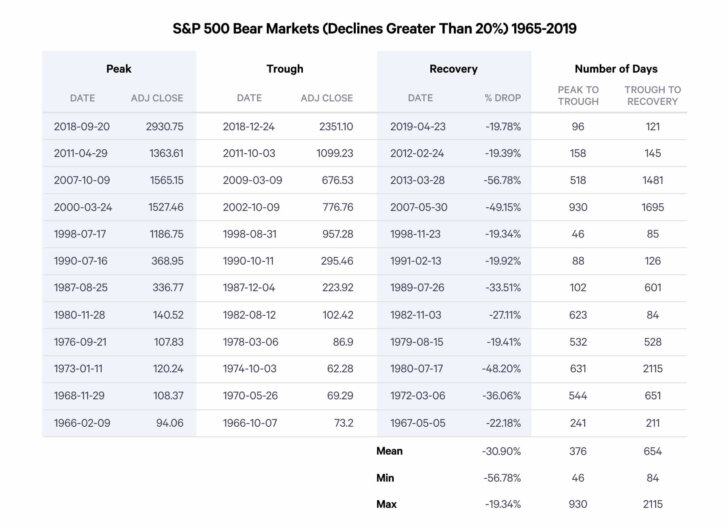

As you might expect, bear markets take longer to recover than corrections. But the good news is bear markets do recover — you just have to have more patience. The mean time to recovery for bear markets is 654 days. But keep in mind the average was highly influenced by the six years it took to recover from the bear market in the 1970s. That means on average, investors who stayed invested after a bear market have historically earned more than 20% in under 1.8 years, which is a very attractive return.

Your superpower: Staying the course

If you plan on saving over the long term, even a bear market shouldn’t stop you from consistently adding to your investment account. In fact, investing in a bear market can actually increase the value of your holdings at retirement because, in effect, you get to buy at a discount all along the way. To put it another way, if an investor started investing on January 1, 1965 and endured all of the corrections and bear markets over the next 55 years until today, they would have seen a compounded return of 6.51%, far in excess of the compounded inflation rate of 3.91%. But human nature is tough to overcome, so while ignoring market corrections and bear markets and staying the course is the right thing to do, it doesn’t necessarily feel that way when markets are volatile. So our advice: use data to guide your decisions, and remember that slow and steady wins the race.

Disclosure

The information contained in this communication is provided for general informational purposes only, and should not be construed as investment advice. Nothing in this communication should be construed as an offer, recommendation, or solicitation to buy or sell any security. Any links provided to other server sites are offered as a matter of convenience and are not intended to imply that Wealthfront Advisers or its affiliates endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Investment advisory services are provided by Wealthfront Advisors , an SEC-registered investment adviser, and brokerage products and services, are provided by Wealthfront Brokerage LLC, member FINRA / SIPC. Wealthfront Software LLC (“Wealthfront”) offers a free software-based financial advice engine that delivers automated financial planning tools to help users achieve better outcomes.

All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Please see our Full Disclosure for important details.

Wealthfront Advisers, Wealthfront Brokerage and Wealthfront are wholly owned subsidiaries of Wealthfront Corporation.

© 2020 Wealthfront Corporation. All rights reserved.

About the author(s)

Andy Rachleff is Wealthfront's co-founder and Executive Chairman. He serves as a member of the board of trustees and chairman of the endowment investment committee for University of Pennsylvania and as a member of the faculty at Stanford Graduate School of Business, where he teaches courses on technology entrepreneurship. Prior to Wealthfront, Andy co-founded and was general partner of Benchmark Capital, where he was responsible for investing in a number of successful companies including Equinix, Juniper Networks, and Opsware. He also spent ten years as a general partner with Merrill, Pickard, Anderson & Eyre (MPAE). Andy earned his BS from University of Pennsylvania and his MBA from Stanford Graduate School of Business. View all posts by Andy Rachleff