As you likely know from the headlines, 2019 was a strong year for financial markets. The S&P 500, which tracks the performance of 500 largest publicly traded companies in the U.S., was up by 28.9%, marking its largest one-year gain since 2013. The MSCI emerging markets index was up 18.4%. By almost any measure, 2019 was very good to investors.

Through it all, Wealthfront continued tax-loss harvesting as part of our unparalleled suite of tax-minimization features. We’ve previously written about how tax-loss harvesting is a great way to offset your losses in a down market. What you might find surprising is that tax-loss harvesting, at least as implemented by Wealthfront, is also incredibly valuable in a year like 2019.

That’s because Wealthfront’s Tax-Loss Harvesting looks for opportunities to harvest losses daily, meaning it takes advantage of the daily volatility of individual investments. As long as there’s volatility in some of your investments from day to day, our software can harvest losses — even when the market is up overall. Very few other services (if any!) actually do this.

Valuable when the market is up

We’ve calculated that for new clients who joined in 2019 with a portfolio risk score of 8 (our most common and average risk score), we were able to harvest losses equal to 4.5% of their portfolio value on average, even in a year when average one-year returns for a taxable portfolio with a risk score of 8 were 23.7%* (our returns are lower than the S&P 500 because our portfolios usually incur lower volatility/risk than the S&P 500, and we aim to maximize risk adjusted returns rather than just returns). This meant they enjoyed an estimated after-tax benefit of 1.13% to 2.25% depending on their tax rates and ability to use the losses — many times the 0.25% annual advisory fee that we charge. Even in an up year, our Tax-Loss Harvesting pays for itself several times over.

As always, some of this benefit could have been lost due to wash sales. Typically wash sales only affect about about 0.15% of transactions at Wealthfront (excluding withdrawals, which sometimes force Wealthfront to sell an investment that creates a wash sale). In the event of a wash sale, the benefit we provide through Tax-Loss Harvesting is just deferred to the following year.

How does it work?

Tax-loss harvesting lowers your taxes by selling investments that have declined in value, thus generating a loss that can be used to offset your other taxable gains. The sold investment is then replaced with a highly correlated alternative investment that maintains the risk and return profile of your portfolio. Wealthfront’s software looks for opportunities to harvest tax losses in this manner every single day.

Let us illustrate the value of Tax-Loss Harvesting with an example. Say you invested in Vanguard’s Total Stock Market ETF (VTI) on August 2, 2019 at $149.58 a share. On August 5, 2019 (the next day the stock market was open), VTI closed at $145.14 — a decline of $4.44 per share, or 2.97%. By the end of 2019, VTI was trading at $163.62, or 9.39% higher than it had been on August 2. If you waited until the end of the year, as is typical of the way human advisors implement tax-loss harvesting, there would have been no loss to harvest. But our software, which looks for volatility every day, would have been able to sell VTI on August 5, replace it with a similar investment, and harvest your loss, thus reducing your tax liability.

Most tax losses that Wealthfront’s software harvests are short-term, meaning we sell investments that you’ve held for less than a year. You can count these losses against your short-term capital gains and up to $3,000 of ordinary income each year.

Our tax-loss harvesting results over the past seven years

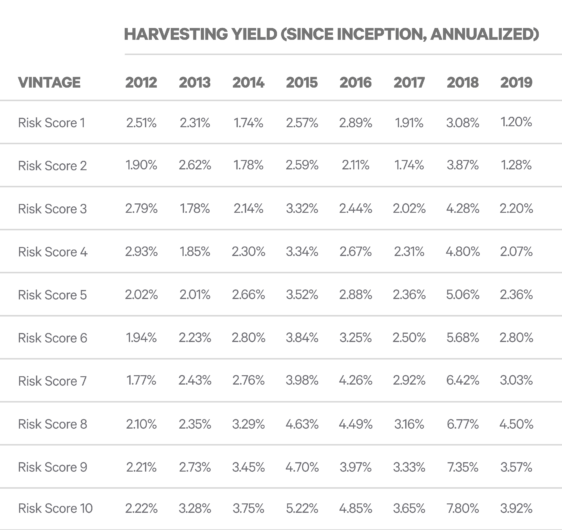

We measure the success of our Tax-Loss Harvesting service by calculating its annual “harvesting yield,” which takes the amount of harvested losses in a given year and divides that quantity by the portfolio’s value at the beginning of that year. The harvesting yield we present below expresses an average. At the individual level, the benefit you receive from Tax-Loss Harvesting depends on several other factors including the timing of your investments and add-on deposits and the riskiness of your portfolio.

Below, you can see the average annual harvesting yield for each portfolio risk score and “client vintage” (when the client first started using Wealthfront’s Tax-Loss Harvesting). This data includes all tax losses harvested through December 31, 2019.

As you can see, annual harvesting yield tends to go down over time. This isn’t a bad thing! Over time, your portfolio should grow in value which means it becomes tougher to find investments to sell that have declined below their purchase price. When we reinvest your dividends and/or you make a deposit, that creates more opportunities for us to keep tax-loss harvesting over time.

In general, higher annual harvesting yield is correlated with higher risk scores. That’s because a riskier portfolio should be more volatile, providing more opportunities to harvest tax losses. That said, we absolutely don’t recommend increasing your risk score just to increase your harvesting yield. There are good reasons and bad reasons to change your risk score, and this blog post can help you tell the difference.

Tax minimization made simple

We believe in transparency, and that includes publishing the results of our Tax-Loss Harvesting service. We know of no other automated investment service that publishes its harvesting yield which should tell you something about how their performance might compare to ours.

In the past, we’ve explained how our Tax-Loss Harvesting is a great way to offset your losses when markets are down. But most people don’t realize that it’s also great in an up market and has historically generated savings worth many times our 0.25% annual advisory fee.

Even in a year when markets were way up, our software took advantage of daily volatility (something a human financial advisor could never do) and harvested losses that lowered our clients’ taxes. Tax-Loss Harvesting is just one piece of Wealthfront’s unparalleled suite of tax-minimization features, and we’re thrilled to offer it to you.

Disclosure

*This average return is based on clients with a taxable account and a risk score of 8 during the time period of 01/01/2019 – 01/01/2020. Not all clients experienced this return. This return is pre-tax and net of fees and includes our daily tax loss harvesting as well as reinvestment of dividends. The risk score of 8 was chosen because it is the most commonly selected risk score of Wealthfront Advisers’ clients. Wealthfront Advisers’ risk scores range from 0.5 to 10 in half integer increments, for a total of 20 different risk profiles, with each risk score having a different risk and return profiles.

The information contained in this communication is provided for general informational purposes only, and should not be construed as investment advice. Nothing in this communication should be construed as an offer, recommendation, or solicitation to buy or sell any security. Any links provided to other server sites are offered as a matter of convenience and are not intended to imply that Wealthfront Advisers LLC (“Wealthfront Advisers”) or its affiliates endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Wealthfront Advisers and its affiliates do not provide legal or tax advice and do not assume any liability for the tax consequences of any client transaction. Clients should consult with their personal tax advisors regarding the tax consequences of investing with Wealthfront Advisers and engaging in these tax strategies, based on their particular circumstances. Clients and their personal tax advisors are responsible for how the transactions conducted in an account are reported to the IRS or any other taxing authority on the investor’s personal tax returns. Wealthfront Advisers assumes no responsibility for the tax consequences to any investor of any transaction.

The effectiveness of the tax-loss harvesting strategy to reduce the tax liability of the client will depend on the client’s entire tax and investment profile, including purchases and dispositions in a client’s (or client’s spouse’s) accounts outside of Wealthfront Advisers and type of investments (e.g., taxable or nontaxable) or holding period (e.g., short- term or long-term).

Wealthfront Advisers’ investment strategies, including portfolio rebalancing and tax loss harvesting, can lead to high levels of trading. High levels of trading could result in (a) bid-ask spread expense; (b) trade executions that may occur at prices beyond the bid ask spread (if quantity demanded exceeds quantity available at the bid or ask); (c) trading that may adversely move prices, such that subsequent transactions occur at worse prices; (d) trading that may disqualify some dividends from qualified dividend treatment; (e) unfulfilled orders or portfolio drift, in the event that markets are disorderly or trading halts altogether; and (f) unforeseen trading errors. The performance of the new securities purchased through the tax-loss harvesting service may be better or worse than the performance of the securities that are sold for tax-loss harvesting purposes.

Tax loss harvesting may generate a higher number of trades due to attempts to capture losses. There is a chance that trading attributed to tax loss harvesting may create capital gains and wash sales and could be subject to higher transaction costs and market impacts. In addition, tax loss harvesting strategies may produce losses, which may not be offset by sufficient gains in the account and may be limited to a $3,000 deduction against income. The utilization of losses harvested through the strategy will depend upon the recognition of capital gains in the same or a future tax period, and in addition may be subject to limitations under applicable tax laws, e.g., if there are insufficient realized gains in the tax period, the use of harvested losses may be limited to a $3,000 deduction against income and distributions. Losses harvested through the strategy that are not utilized in the tax period when recognized (e.g., because of insufficient capital gains and/or significant capital loss carryforwards), generally may be carried forward to offset future capital gains, if any.

Investment advisory services are provided by Wealthfront Advisors , an SEC-registered investment adviser, and brokerage products and services, are provided by Wealthfront Brokerage LLC, member FINRA / SIPC. Wealthfront Software LLC (“Wealthfront”) offers a free software-based financial advice engine that delivers automated financial planning tools to help users achieve better outcomes.

All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Please see our Full Disclosure for important details.

Wealthfront Advisers, Wealthfront Brokerage and Wealthfront are wholly owned subsidiaries of Wealthfront Corporation.

© 2020 Wealthfront Corporation. All rights reserved.

About the author(s)

The Wealthfront Team believes everyone deserves access to sophisticated financial advice. The team includes Certified Financial Planners (CFPs), Chartered Financial Analysts (CFAs), a Certified Public Accountant (CPA), and individuals with Series 7 and Series 66 registrations from FINRA. Collectively, the Wealthfront Team has decades of experience helping people build secure and rewarding financial lives. View all posts by The Wealthfront Team