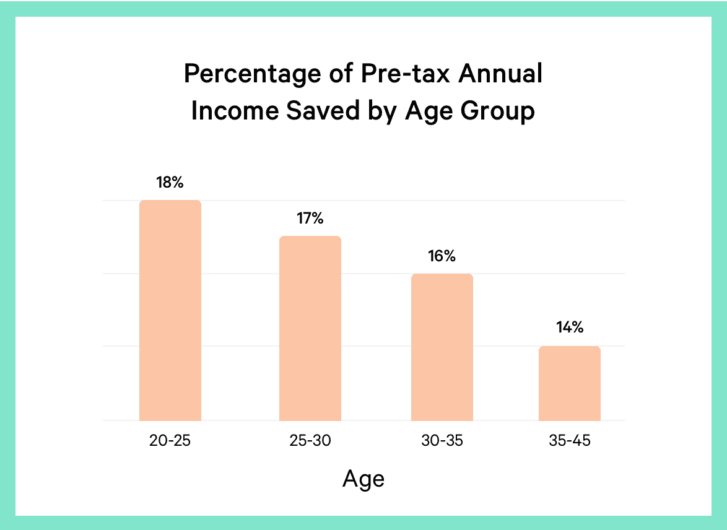

We analyzed our millennial clients’ savings rates, and the numbers paint a very encouraging picture. Our youngest clients (age 20-25) actually save at the highest rate: 18% of their pre-tax annual salary.

A recent survey showed that Wealthfront clients are financially intentional and proactive: a winning combination that is setting them up for long-term success. We were pleased to see that the majority of our clients feel on track to meet their goals and are stashing money in emergency funds and retirement accounts.

But while surveys capture attitudes and beliefs, it’s data that completes the story. We decided to crunch the numbers and analyze our millennial clients’ total savings rates to better understand their savings behavior. (Read the full description of our methodology here.)

The numbers paint a really encouraging picture about our younger clients: they know how to save. Read on for more insights.

Our youngest clients are off to a great start

Thanks to increased life expectancies, reduced Social Security benefits, and a lack of pensions, the National Institute on Retirement Security (NIRS) reports some bleak millennial savings trends: this generation may need to save 15% to 22% of their annual salaries to make it through retirement. That’s double the 10% savings rate recommended for previous generations — and the report showed that only 5% of millennials across America are meeting it.

The NIRS report also found that 66.2% of millennials have nothing saved for retirement. Of the people with retirement accounts, the vast majority (82.4%) save less than 6% of their annual salary.

The good news is that Wealthfront clients are bucking those millennial savings trends. We found our youngest clients actually save at the highest rate. Our data shows that, on average, our 20 to 25-year-old clients are saving 18% of their pre-tax annual salary — that’s around 3x the national savings rate. (Note: While our younger clients are saving at higher rates than other age groups, they save less money overall.)

“It is rewarding to see data demonstrate that our clients don’t fit the tired narrative that millennials don’t save and plan for the future,” says Daniel McAuley, our Principal Data Scientist. “We are excited to see what we learn next about ways to positively affect client financial behavior through software and education.”

Our clients’ annual savings rates are very encouraging — and when it comes to total amount saved to date, the data is also promising. For example, our average 20 to 25-year-old client has accumulated the equivalent of 40% of their annual pre-tax salary across different types of accounts (including retirement accounts). That number rises to 50% for the 25 to 30 bracket, and 86% for those aged 30 to 35.

Wealthfront client Levi Francis, a 25-year-old engineer living in Cleveland, OH, is just one example of a younger millennial motivated to save. He has his eye on achieving financial independence and wants to retire by age 55. “When I save, I’m paying my future self,” says Levi. “I want to have many active years without worrying about generating income. That reality is very liberating.”

The more you earn, the more you save? Not exactly…

One of the perennial rules of personal finance is to avoid “lifestyle inflation”: increasing your spending at the same rate as your earning. In other words, you shouldn’t trade your Camry for a Lexus just because you got a raise. Instead, you should increase your savings rate.

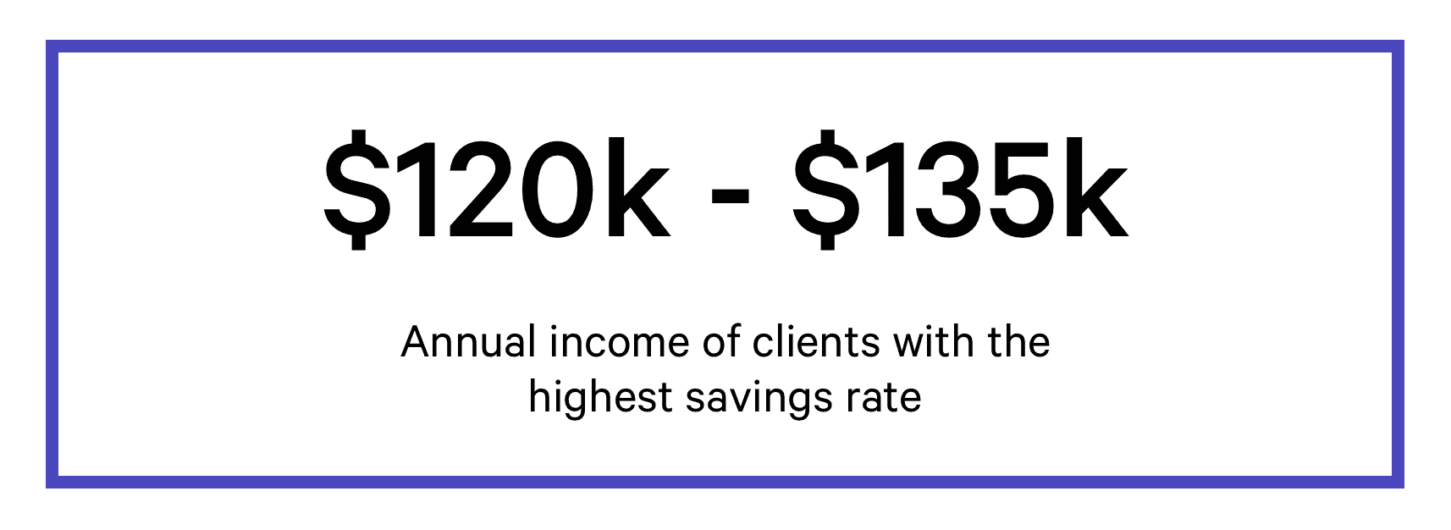

Our clients adhere to that rule… to an extent. We found that savings rates increased alongside salaries until clients started making more than $135,000 per year. After that, savings rates flattened out, and then slightly decreased.

This means that clients making between $120,000 and $135,000 per year saved at slightly higher rates than any other group — including those who make more than $200,000 per year.

“While you should celebrate a hard-earned promotion or salary increase, a raise shouldn’t mean a dramatic lifestyle change,” says Ashley Fieglein Johnson, our Chief Operating Officer and Chief Financial Officer. “Financially, the smartest post-raise move is to funnel your extra money straight into debt payoff or investments — and not change your spending habits.”

Wealthfront client Parth Patel, a 24-year-old working in financial services in Richmond, VA, follows that advice. As he’s gotten promotions and raises at work, he tries to scale his savings at a similar rate. “It’s easy to avoid lifestyle creep if your extra income goes straight to savings,” Parth says.

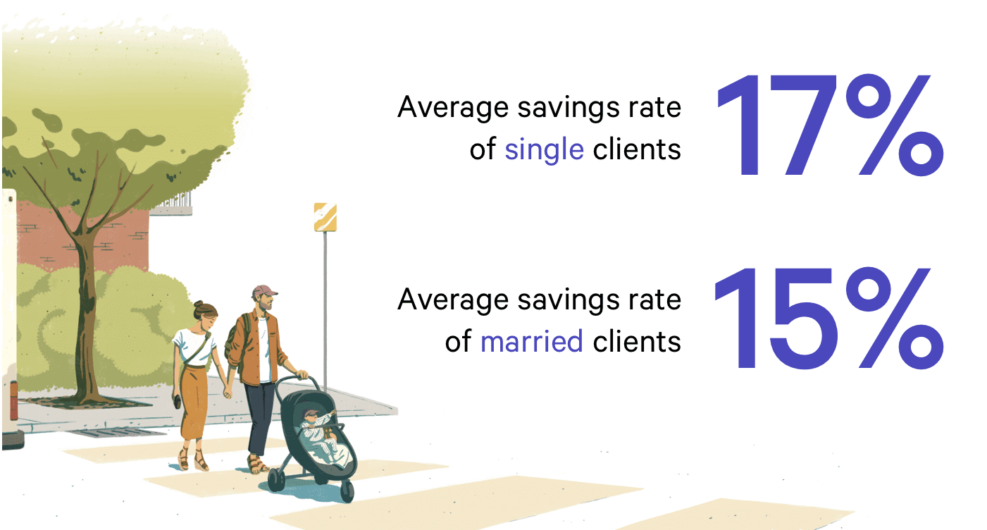

Single and ready to save

Judging from the way young, single millennials are often portrayed in the media, you would assume they waste their money on avocado toast and designer coffee. Once again, Wealthfront clients emphatically dispel those myths. We found that, on average, our single clients save at higher rates than our married clients.

Our bachelors and bachelorettes save an average of 17% of their pre-tax annual salary, a couple of percentage points higher than our married clients (15%). Our “high saver” clients — those squirreling away more than 20% of their salaries each year — are also more likely to be single.

While we don’t have hard evidence as to why this is happening, our hunch is that the expenses that come with settling down — namely, paying for a wedding, buying a home, and having a child — tend to drive up expenses for a new couple. And that means their savings rate can flatten, and that their savings accounts might even take a dip.

The magic of time

One of the key benefits for our younger clients with good savings hygiene? Time. Clients who start saving early in their adult lives will benefit from the incredible power of compounding. And the longer they use a solution like Wealthfront, the better. In fact, we found that engaging with our financial advice engine, Path, correlates to an almost 28% increase in a client’s savings rate.

Learn more about starting your own savings journey here.

Methodology

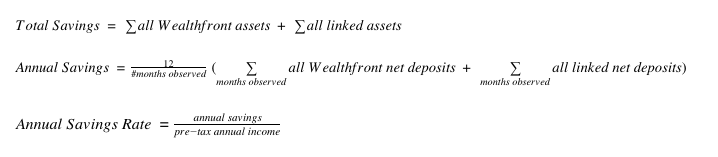

Our research team looked at Wealthfront Advisers LLC (“Wealthfront Adviser”) client data from 8/1/2017-10/10/2018. We included clients who adhere to the following restrictions:

1. Self-reported pre-tax annual salaries (joint) between $30,000-$500,000

2. Age between 20-70 years old

3. At least 1 account linked (does not include illiquid accounts, such as real estate, etc.)

4. At least two months in which we observe transactions across all accounts considered

5. Have raw annual savings rate estimates between the 10th and 90th percentiles observed in the sample

6. Have all monthly savings rate estimates above the 10th percentile of the minimum monthly savings by users, and the 90th percentile of maximum monthly savings by users

7. At least 80% of reported net worth is visible (linked or at Wealthfront)

Calculations involving percent of salary saved used median values in order to better understand the behavior of our average client and avoid positive skew due to high net worth individuals.

Calculations involving savings rate used mean values, and we controlled for high influence outliers using restrictions #5 and #6.

Disclosure

This blog is powered by Wealthfront Advisers LLC (“Wealthfront Advisers,” and the successor investment adviser to Wealthfront Inc.). The information contained in this blog is provided for general informational purposes, and nothing in this material should be construed as an investment or tax advice, a solicitation or offer, or recommendation, to buy or sell any financial product or securities. Any links provided to other server sites are offered as a matter of convenience and are not intended to imply that Wealthfront Advisers or its affiliates endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise. No representation or warranty, express or implied, is made or given by Wealthfront Advisers or its affiliates as to the accuracy and completeness or fairness of the information contained in the links, and no responsibility or liability is accepted for any information provided in such links.

Wealthfront Advisers may from time to time publish content in this blog and/or on this site that has been created by affiliated or unaffiliated contributors. These contributors may include Wealthfront Advisers employees, other financial advisors, third-party authors who are paid a fee by Wealthfront Advisers, or other parties. Unless otherwise noted, the content of such posts does not necessarily represent the actual views or opinions of Wealthfront Advisers or any of its officers, directors, or employees. The opinions expressed by guest bloggers and/or blog interviewees are strictly their own and do not necessarily represent those of Wealthfront Advisers or any of its affiliates. Wealthfront Advisers is a SEC registered investment adviser, and a wholly owned subsidiary of Wealthfront Corporation.

© 2018 Wealthfront Corporation. All rights reserved. Please read important legal disclosures about this blog.

About the author(s)

The Wealthfront Team believes everyone deserves access to sophisticated financial advice. The team includes Certified Financial Planners (CFPs), Chartered Financial Analysts (CFAs), a Certified Public Accountant (CPA), and individuals with Series 7 and Series 66 registrations from FINRA. Collectively, the Wealthfront Team has decades of experience helping people build secure and rewarding financial lives. View all posts by The Wealthfront Team